At RightCapital, we’re always striving to improve our platform to help advisors deliver exceptional financial planning experiences. In 2024, we introduced a range of exciting new features and enhancements designed to save time, improve efficiency, and strengthen advisor-client relationships. Here’s a look at some of the top updates that made waves this year:

RightFlows™: Streamlining Financial Planning Workflows

In January 2024, we launched RightFlows™, the first financial planning workflow tool to incorporate direct client collaboration. This innovative tool helps firms manage financial planning processes and tasks across advisors, assistants, and clients, all within a centralized dashboard.

Key benefits of RightFlows:

Task automation: Assign tasks to clients, advisors, or assistants, and let RightFlows automatically trigger the next steps in the workflow.

Time savings: Easily track where each client’s financial plan stands and identify next steps from the centralized dashboard.

Organizational efficiency: Standardize planning processes while allowing flexibility for advisors to adjust specific steps or tasks as needed.

RightFlows has already transformed how advisors manage their workflows, making financial planning more efficient and collaborative than ever before.

RightFlows is available within the Platinum subscription. To upgrade your subscription, contact our sales team at sales@rightcapital.com or (888) 982-9596; Option: 1.

RightRisk™: Simplifying Risk Assessments

In the spring of 2024, we introduced RightRisk™, a fully integrated risk assessment module that simplifies how advisors incorporate risk tolerance into financial plans.

Key features of RightRisk:

Household risk summary: Compare a household’s risk score to its current portfolio, target portfolio, and major asset classes.

Visual risk-return analysis: Help clients understand the potential upside and downside returns for their portfolios.

Customizable questionnaires: Use our default 13-item questionnaire or create your own, with the ability to copy and modify existing versions.

Flexible client engagement: Launch questionnaires during live meetings or save them for clients to complete later.

RightRisk is included with RightCapital’s Premium subscription or higher, making it easier than ever to integrate risk assessments into your planning process.

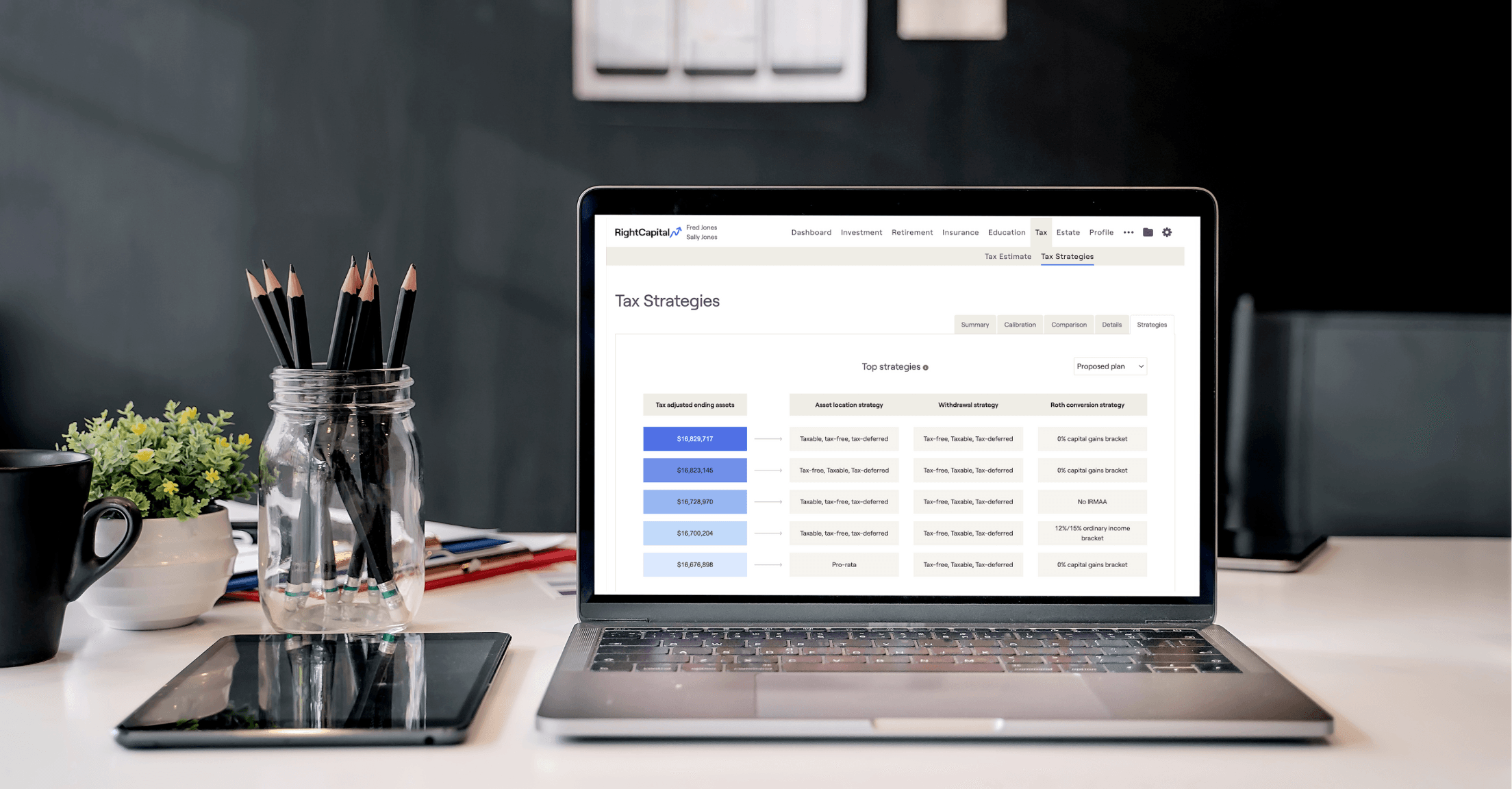

One-Click Solver for Optimal Tax Strategies

The new Tax Strategies tab within the Tax module introduces a one-click solver that determines the optimal tax outcome for each client. This feature evaluates potential results and generates five scenarios with the highest tax-adjusted ending assets. Visualize asset location and set an appropriate asset location strategy for clients before they reach retirement age.

Onboarding Templates for a Seamless Start

We’ve made onboarding easier than ever with customizable templates for new clients. Advisors can now choose between the "Profile" card approach or the "Blueprint" method, based on our popular Blueprint visualizations.

Key features of Onboarding Templates:

Streamline the initial data entry stage to save time and improve the client experience.

Customize templates for new clients and prospects or apply them to existing clients.

Include uploading documents to the secure Vault and assigning Risk Questionnaires as steps in the onboarding process if you’d like.

Enhancements to Estate Planning

We’ve introduced the following updates to the Estate module to help advisors model more complex strategies, tailored to client’s unique needs:

Future trust funding: Model proposed trust strategies to start immediately or in a future year, with options to specify cost-basis ratios.

State estate taxes: Automatically calculate estate taxes for the 13 states that impose additional estate taxes, based on the client’s state of residence.

Annuity Models for Greater Flexibility

Advisors can now create model annuities to populate annuity information within client plans. These models allow you to specify annuity type, details, and multiple distribution options. Super admins can also create firm-wide models for consistency.

Integrations to Expand Your Capabilities

We’ve added several new integration partners to help advisors consolidate client data and provide a seamless planning experience:

Flourish: Bring in cash account balances and annuity contract data directly into the Net Worth tab.

Nationwide Advisory: Link traditional and advisory annuity account data to client plans.

MaxMyInterest: Connect savings and checking account balances for a more complete financial picture.

Budget Updates for Simplicity and Efficiency

We’ve made budgeting more intuitive with new features:

Budget category templates: Set up expense, income, and other budget categories to apply across client plans.

Copying detailed expenses: Duplicate monthly expense figures between Budget, Pre-retirement Living, and Retirement Expense cards for faster data entry.

Time-Saving Enhancements

We’ve introduced several updates to help advisors work more efficiently:

Quick fill for Glide and Scenario models: Populate annual percentages for Equity, Fixed Income, and Cash with just a few clicks.

Copy models and templates: Duplicate existing models and templates to streamline workflows.

Navigation enhancements: Quickly transition between the Advisor Portal and client plans with automatic highlighting of the most recently accessed household.

Improved Flexibility Across the Platform

We’ve added new features to give advisors more control and customization options:

Custom vesting schedules: Create vesting schedules on an annual, semi-annual, quarterly, or monthly basis.

Expanded number of assets and liabilities: Accommodate up to 100 properties, loans, businesses, or other assets.

Default visibility for Tasks and Notes: Set preferences for whether tasks and notes are visible or shared with clients.

Visual and Usability Updates

We’ve refreshed several areas of the platform to improve usability and aesthetics:

Net worth redesign: A modernized look with better organization and a new Connections panel for account aggregation.

Goals board view: A new "board view" option for household goals, organized by category and dollar value.

Drag-and-drop Action Items: Reorder action items directly within Retirement, Insurance, and Estate modules for easier customization.

We’re excited to see how you’ll use these tools to grow your practice and strengthen client relationships!