Almost 50% of financial advisors save time by utilizing collaborative planning software

According to the January 2023 Kitces Report, “How Financial Planners Actually Do Financial Planning (2023)”, “Nearly half of advisors now use planning software as a collaborative tool, developing plans with the client live in ‘real time’.” The report provides a few benefits to the collaborative approach in that it “is less costly to deliver and likely a more satisfying experience for the client” and that the typical collaborative plan is prepared in less time than the traditional comprehensive plan. Better client experience combined with cost and time efficiency? Count us in.

RightCapital’s Customer Relationship Lead, Alexus, hosted a recent webinar detailing how financial advisors can elevate client engagement. Catch the full recording here, or keep reading on for tips on boosting client engagement with RightCapital’s client portal, personalized client access levels, risk assessment tool, Tasks function, and more:

Customize the client portal to individuals' needs

Just as you may feel more comfortable and confident in a pair of jeans tailored to your exact measurements, your clients will feel more comfortable and confident using a financial plan that is tailored to them and their particular financial situations. With RightCapital, personalization extends beyond refining the client portal with your brand’s colors and logos. The software allows you to highlight specific modules meaningful to each client.

For example, your retiree clients may not find relevance in a Student Loan module, and your Gen Z clientele might not be ready for Estate Planning discussions. You control which modules show up in each client plan, whether by individual plan or by client group. Some advisors use this functionality to begin their relationships with just a few modules and add more as their relationships and conversations develop over time. Take advantage of Planning Access templates to avoid starting from scratch for clients requiring similar levels of access. Customizing the portal can be a great way to provide a tailored, white glove approach and to make your clients feel your dedication to them and their plan.

Choose your client access level

While you can absolutely collaborate on a plan without granting portal access to your client, offering them this option might enhance their experience. You'll likely notice some clients enjoy a hands-on approach, exploring their plans independently, whereas others might prefer your guidance at each step. With RightCapital, you can tailor client access levels by individual plans, client group, or with a preset template.

The “Client Access” tab gives you the control to determine how clients interact with profile items—whether they can update profile information or not—and action items. With action items, clients can either view only, try different action items with their changes being saved, or try different action items without their changes being saved. The latter option provides your clients with an immersive, interactive experience, seeing how their changes impact the financial plan without the risk of overwriting your proposals.

Balance risk tolerance and risk capacity with RightRisk™

It’s important to get on the same page about what levels of risk your clients are both comfortable taking and able to take based on their current financial situations. You can assess a client’s risk tolerance and risk capacity right within RightCapital. Assign the provided Grable and Lytton questionnaire or create your own questions and answers to determine client risk levels, then analyze the client’s current portfolios to confirm if they are aligned.

RightRisk is a new-in-2024 module for Premium and Platinum subscribers that simplifies how you incorporate risk assessments into your financial plans. Visit this page or watch this video to learn more:

Keep yourself, your team, and clients up to date with Tasks

Engage directly with clients and keep them involved in the planning process in between meetings by utilizing RightCapital Tasks. Clients can personalize how they'd like to be notified about these Tasks. Options range from seeing them upon portal login to receiving a daily email compilation of all notifications or individual emails for each Task. Firms like The Table Financial Planning find that the Tasks module is instrumental in holding their clients' attention.

Just like with other customizations, you can create templates for Tasks if you have consistent recurring Tasks, such as during the onboarding or annual review processes. Assign Tasks to clients, co-clients, or yourself. You can even assign internal workflows to other members of your firm with RightCapital’s workflows management tool available with Platinum subscriptions, RightFlows. Tasks meant for internal reference can be made invisible to the client. To facilitate even more interactive opportunities, you may choose to grant your clients the ability to assign Tasks back to you.

Foster stronger communication with Notes

Providing additional context to your clients' plans can enhance their sense of being informed and involved. With the Notes feature in RightCapital, advisors can offer extra insight and remember key details. Notes can be added in individual modules across the plan. If you wish to keep certain information just for your reference, you can opt to "hide" those Notes by marking them as not shared with the client.

View all Notes associated with a client plan under More (the three dots) > Notes. There are separate tabs for Plan Notes (Notes that are visible to the client) and Advisor Notes (hidden Notes).

Interact with the current plan in the Blueprint™ module

For a successful collaborative plan, it's important that clients comprehend what is presented to them. One of RightCapital's key visual tools is Blueprint, which elegantly displays the client's current plan in an intuitive, interactive chart. Blueprint transforms the data input into the client's plan and presents it in terms of account ownership (client, co-client, joint), yearly goals, and valuations by income, savings, and expenses. Adjusting any element is as simple as clicking into each piece.

Personalize even further with the Snapshot™ summary

Snapshot is a dynamic tool in RightCapital to further refine your client discussions. Select specific widgets and charts you want to spotlight, as well as additional details you'd like to share via text boxes. Advisors utilize text boxes in many ways, from sharing calendar scheduling links for easy follow-up, to current meeting action items, next steps, and recommendations. This feature provides yet another avenue to maintain clear, open communication with your clients.

Answer questions with Cash Flow Maps

Another impactful visual feature that resonates with clients is Cash Flow Maps. This tool shows the sources of their income, expenditure areas, and overall savings. It's a conversation starter, as the client will be able to understand how their cash flows evolve over time and with key financial milestones such as retirement. These maps can be presented in the aesthetically pleasing Waterfall style (known to some as a Sankey chart) or the Breakdown style, which looks more like an org chart. When viewing the Breakdown chart, you can dive deeper into each box for further insights and information.

Provide access to the mobile app for clients to view finances on the go

Offering your clients access to the RightCapital mobile app can significantly expand engagement opportunities and empower them to monitor their finances flexibly and conveniently. The RightCapital mobile app is an effective tool that assists your clients in budgeting, maintaining alignment with Tasks, safely sharing documents using Vault storage, reviewing crucial metrics and accounts at a glance, and examining asset allocation in greater depth. This mobile solution brings the power of financial planning right into their pockets.

Keep track of client engagement on RightIntel™

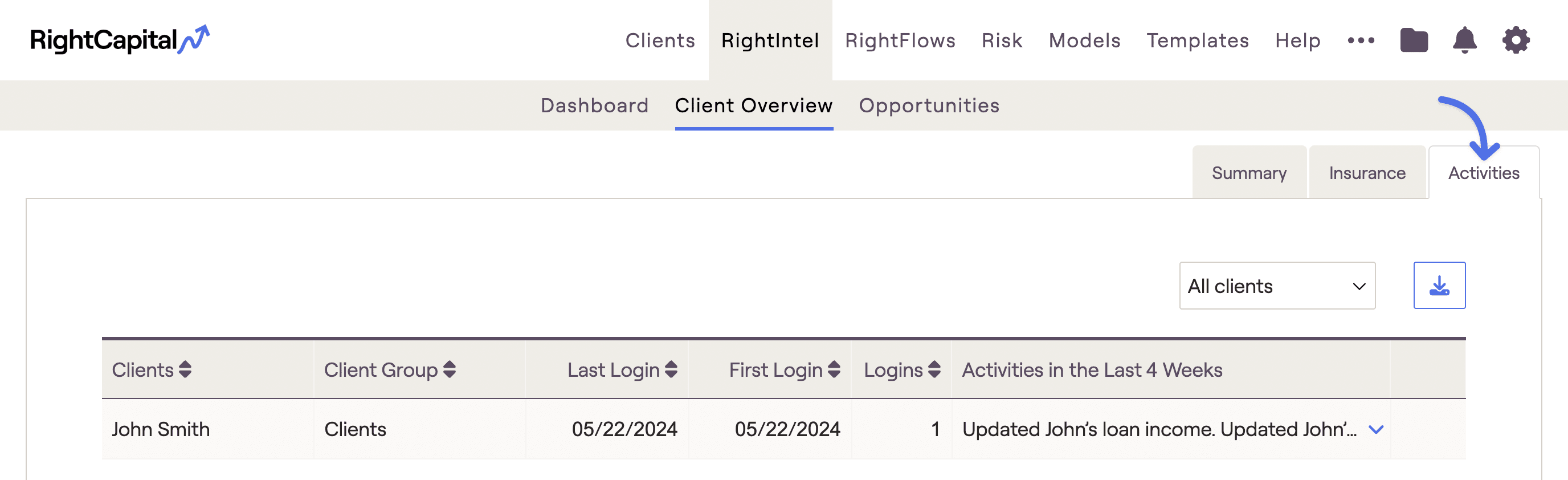

Advisors can monitor client engagement under the Client Overview > Activities section within RightIntel, which also serves as RightCapital’s business intelligence dashboard for Premium and Platinum subscribers. Here, you can track initial logins, the most recent logins, and the elements clients have interacted with in the past four weeks. This feature offers valuable insights into your clients' engagement pattern, helping you to tailor your services and strategies.

Ready to enrich your client experience and save time simultaneously? Arrange a personalized 1:1 demo of RightCapital today: