How This Breakaway RIA Streamlines Client Onboarding

October 9, 2024

Jim Carlson operates Carlson Planning Co., a solo RIA in Massachusetts, with a mission to simplify financial planning for clients pursuing their money goals. As the sole advisor, Jim specializes in guiding individuals through significant life events such as marriage, business launches, long-term care planning, and major purchase savings. His expertise extends beyond mere advice; Jim aims to empower his clients—many of whom are firefighters—with the knowledge and tools for informed decision-making. Operating independently, he strives to instill a sense of financial independence and confidence in his clients, leveraging his solo practice to provide personalized, focused attention to each individual's financial well being.

Breakaway RIA challenges

Advisors launching RIA firms find themselves rewarded with independence and the autonomy to make their own decisions. This independence, however, is often accompanied by an array of challenges stemming from the responsibility of overseeing all facets of their businesses.

One of the immediate hurdles is often a small team (and sometimes just one person) juggling various roles and responsibilities. In such a setting, operational efficiency becomes imperative, particularly for repetitive processes like client onboarding. Another challenge lies in delivering the personalized, white-glove service that clients often associate with larger, more established firms. Balancing this high standard of service with the constraints of a smaller operation demands strategic client relationship management. Lastly, advisors need to effectively validate their fee structure. It is important to convince clients that their advisors’ fees are a true reflection of the high-value service they provide.

Balancing these elements can present a steep learning curve for solo RIA firm owners as they transition to their new leadership roles.

How Jim manages these challenges

In order to keep Jim’s processes buttoned up without them bogging him down, he makes use of automations and workflows within his tech stack. He uses a technology-forward onboarding process to take clients from signing a client agreement to making sure they can begin the planning process.

Operational efficiency during onboarding

To begin, Jim completes several steps in his CRM with a new client, such as signing a client agreement, confirming their contact information, subscribing them to his newsletter, and more. He keeps certain tasks within the CRM, such as dates and documents a regulator might be interested in but that clients don’t necessarily need to have front and center. Having these boxes checked helps him stay compliant with ever-evolving regulations.

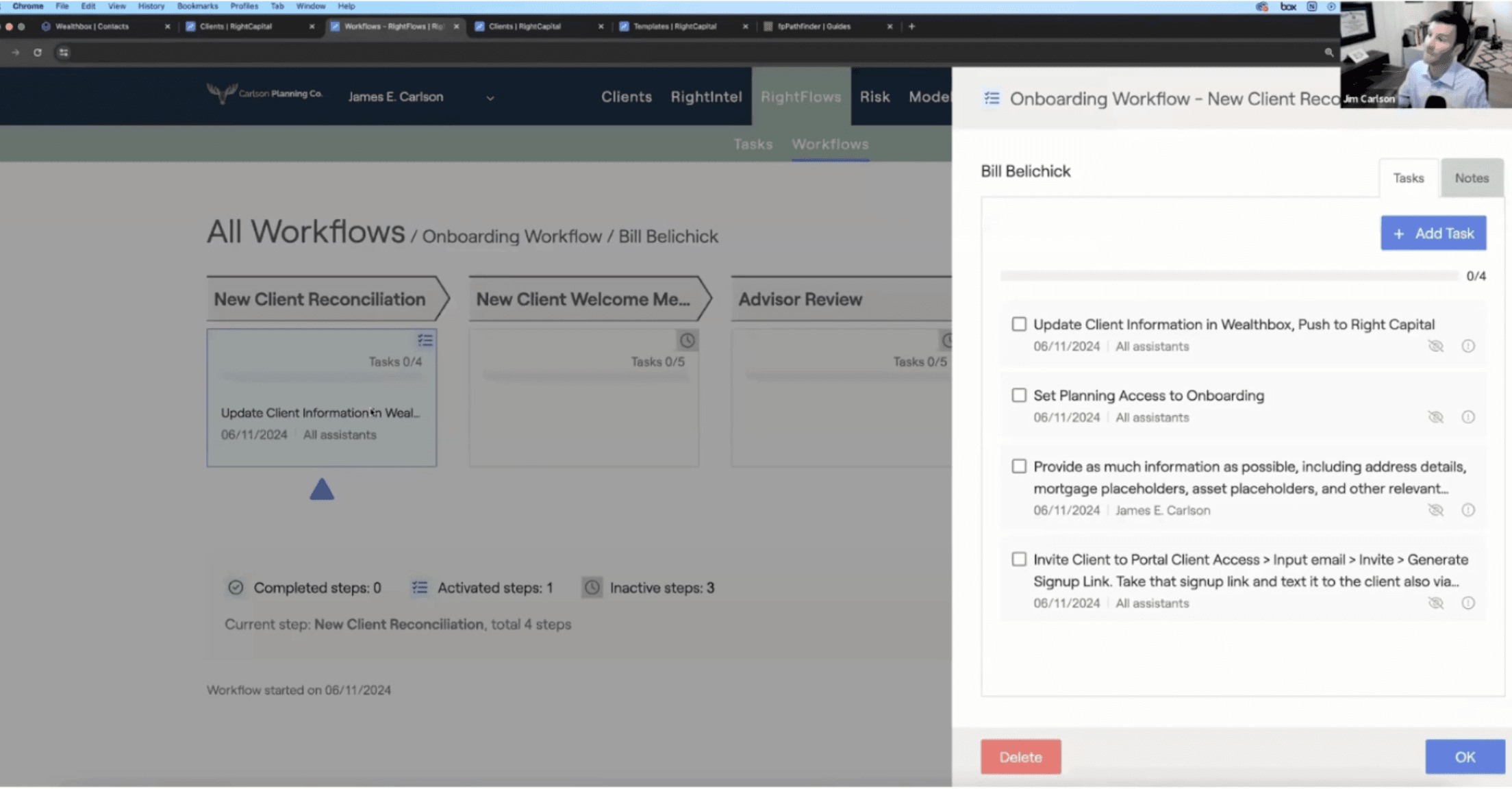

For Jim’s client-facing tasks, he uses RightCapital RightFlows. Through an integration, he moves the client over to RightCapital directly from his CRM. The client’s name, contact information, and date of birth are populated within RightCapital for Jim to move forward with a financial plan.

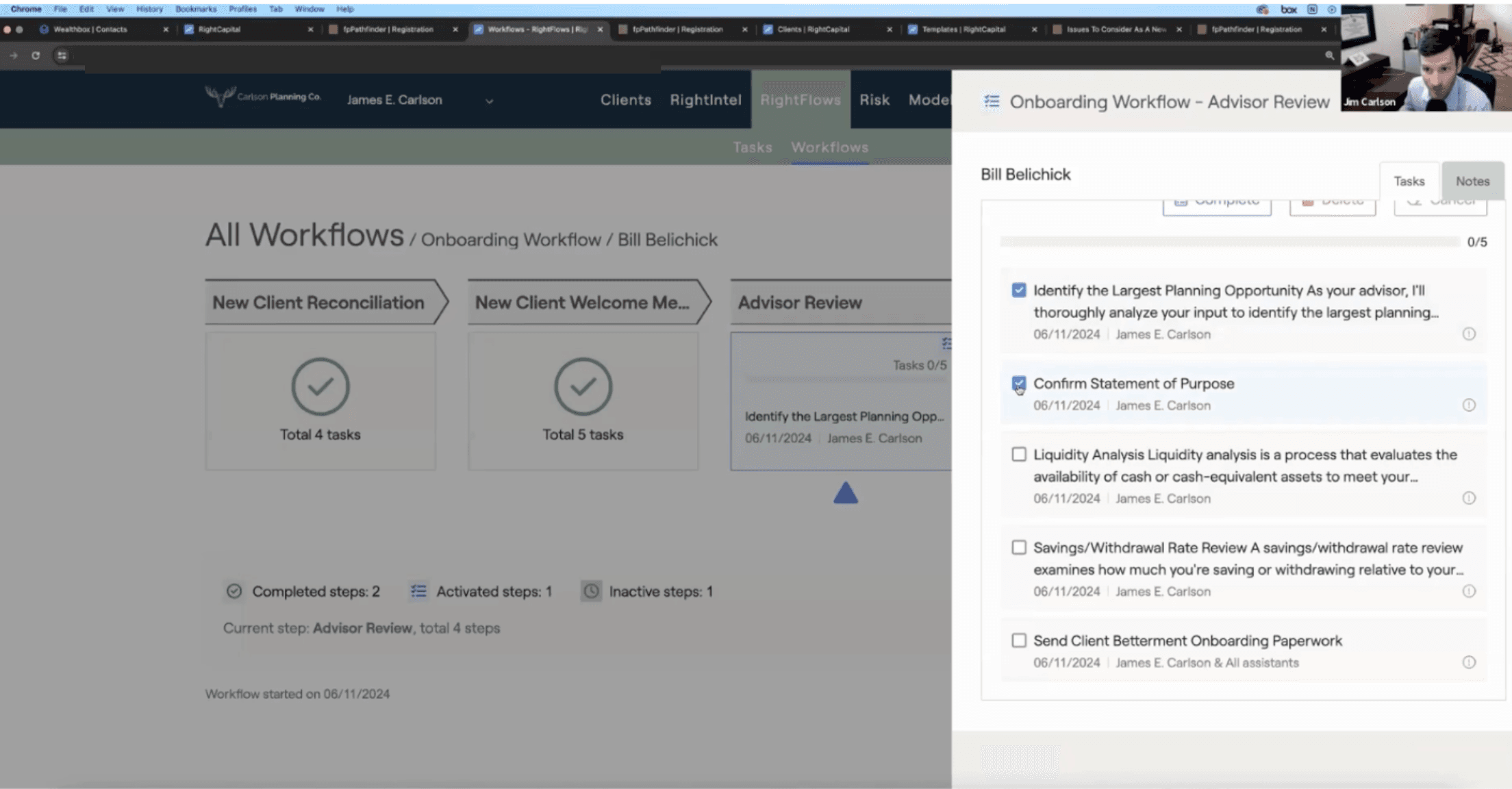

Within RightCapital, Jim created a four-step workflow that he uses for each new client. Initial internal tasks include setting the client up in the CRM, customizing client access, entering the known financial data, and inviting the client to the client portal to fill in the rest.

A better client experience

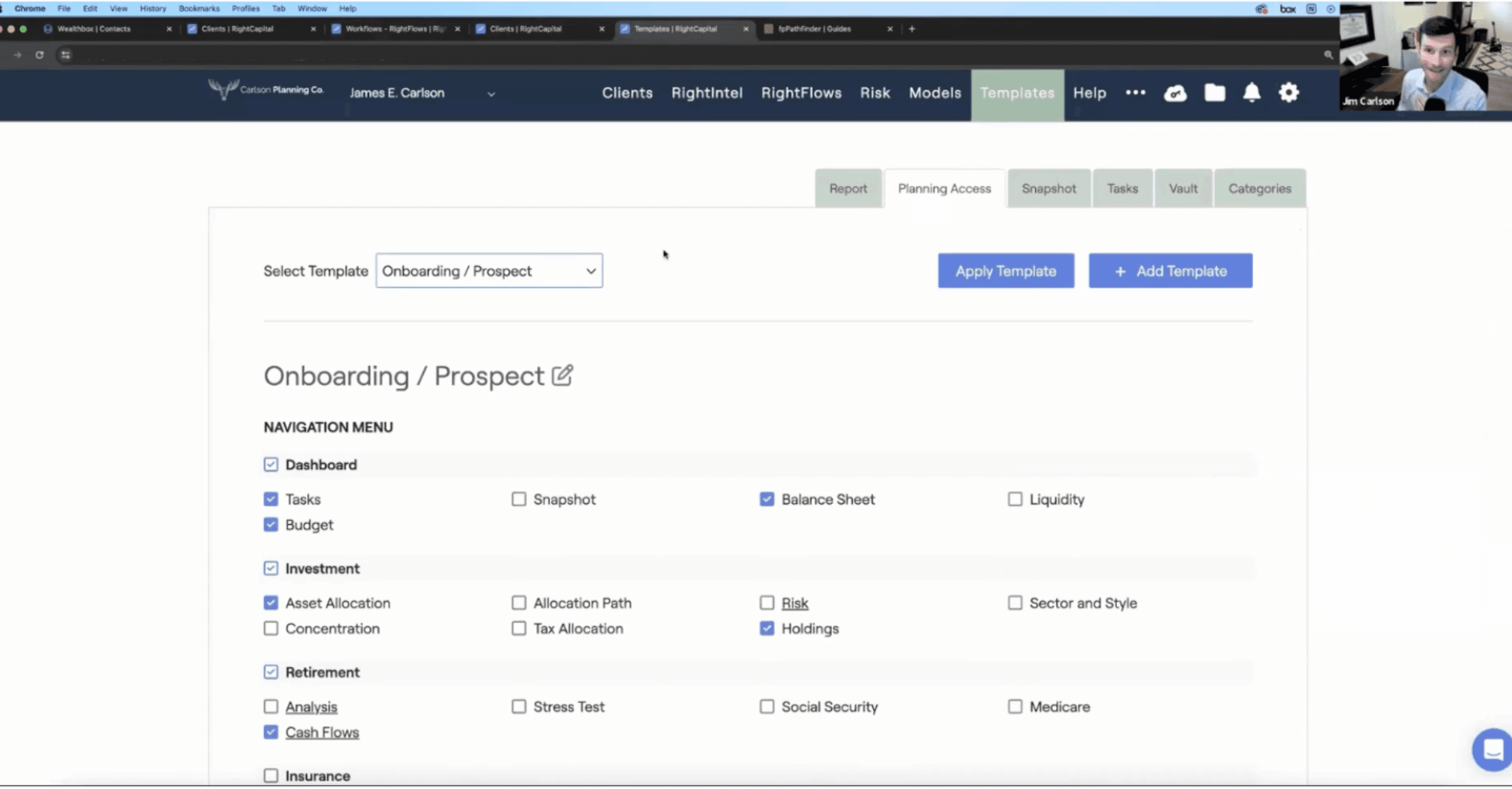

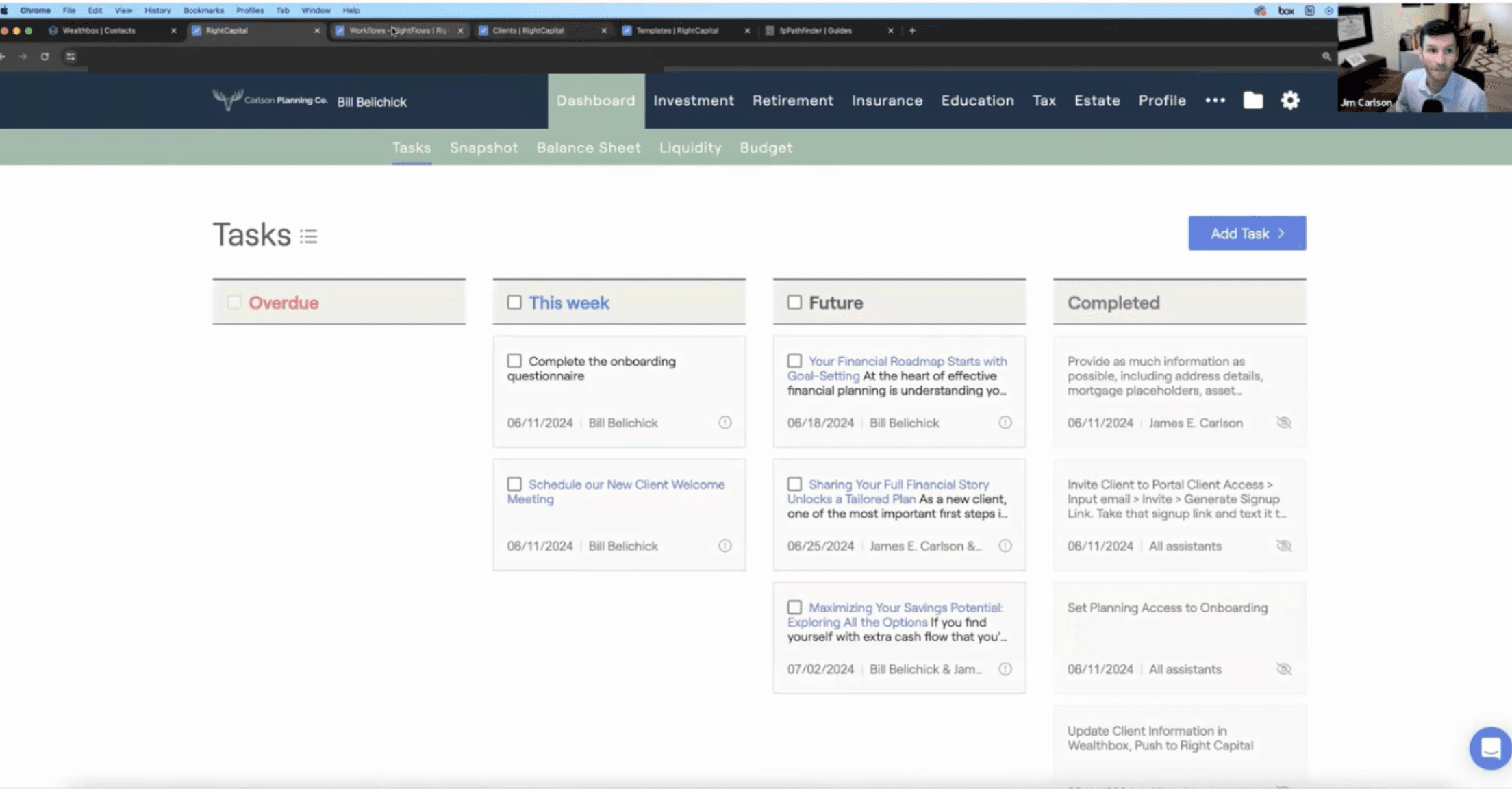

Jim noted, “We have the ability to customize how clients see and interact with RightCapital.” Jim prefers that the client first sees a list of tasks to keep the financial planning engagement moving along. He continued, “I don't want them to get bogged down in the weeds with all the different bells and whistles that our financial planning software has. I try to scrape that down so all they see when they log in or what we immediately need to do to keep that moving.” This thought process influences his client access preferences as to which modules they see and in what order.

When the client first logs into the portal, they see Jim’s Onboarding Workflow with a series of assigned tasks aimed to help them navigate the system. An introduction email is sent by Jim with additional links to his meeting scheduler and onboarding questionnaires for the firm to start better conversations by learning more about clients’ goals and financial histories. This process results in a streamlined and organized approach for onboarding clients, making it easier for them to understand and interact with the financial planning platform.

Later, when tasks are completed, Jim receives notification emails to keep track of what’s being done and what’s not being done, in case there are clients who need some hand-holding along the way.

Personalized plans

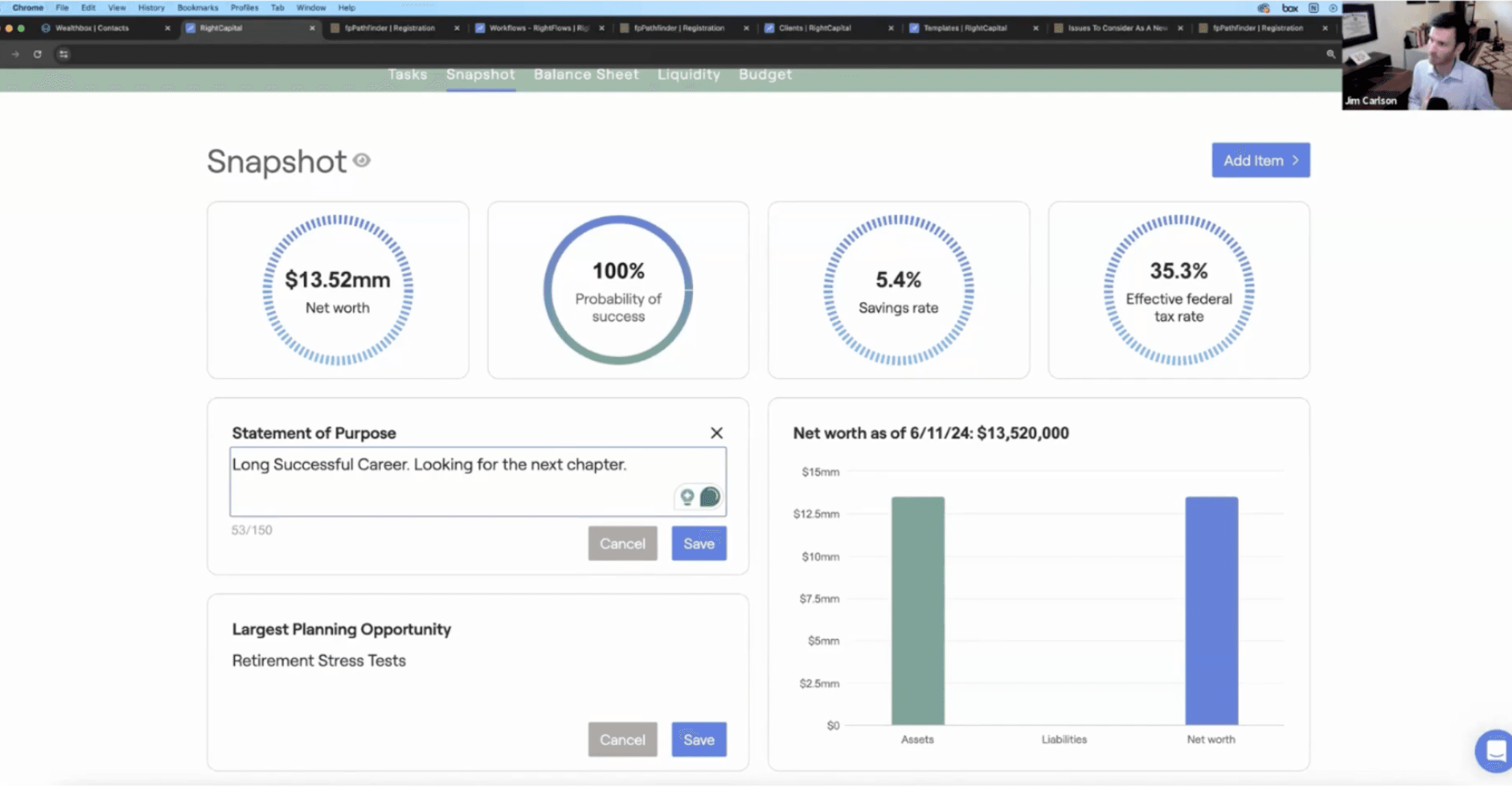

With information received from the questionnaires and the discovery meeting, Jim personalizes the RightCapital Snapshot dashboard to each client with additional internal tasks in the workflow. To find the largest planning opportunity, Jim asks, “What is the most meaningful thing that if the client were to walk away and implement that they would be better for?” He also reviews each client’s “Statement of Purpose” or “What is important to clients and where are they going.” Jim enters both of these answers into the Snapshot into custom Notes sections.

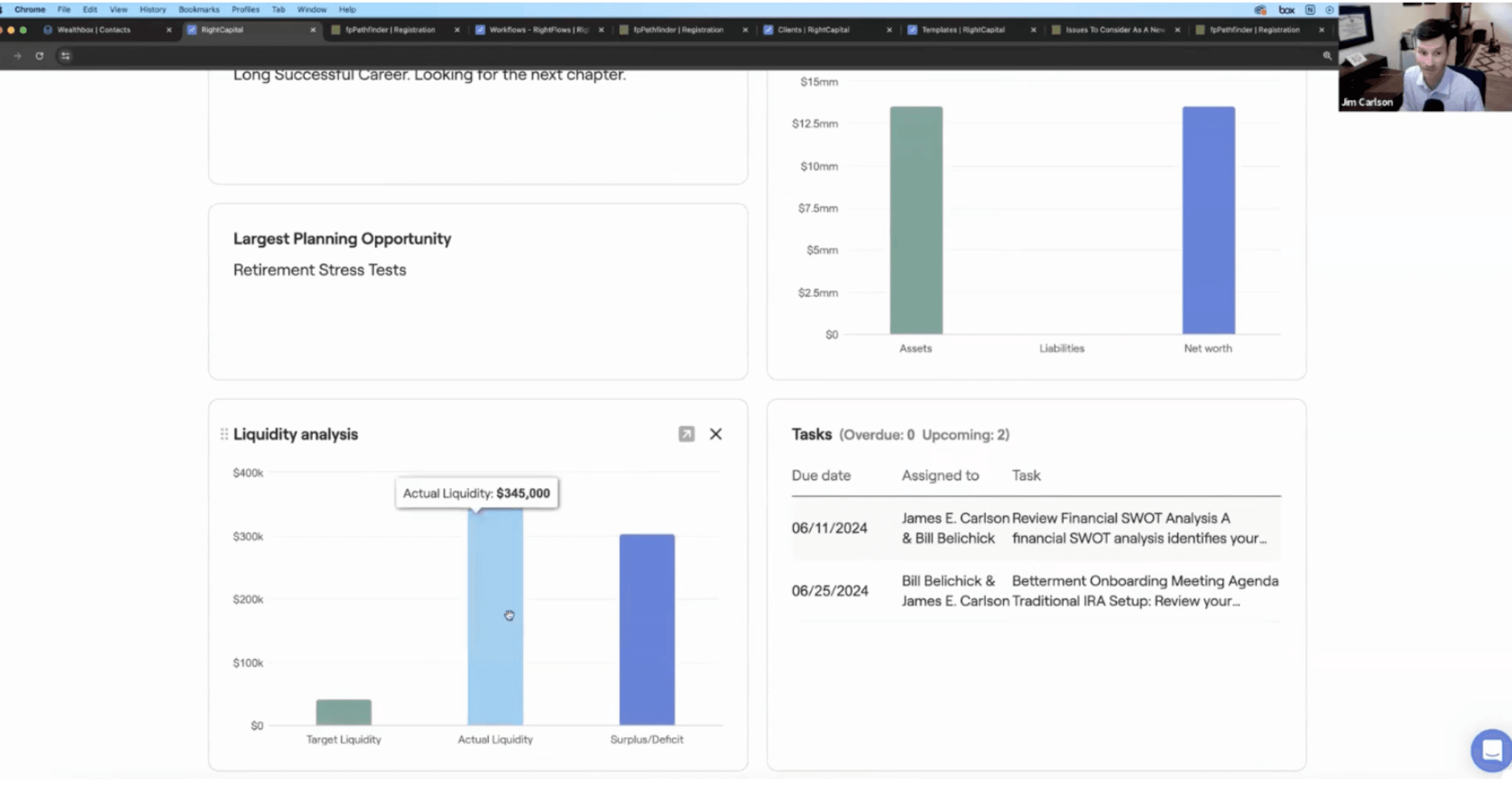

Jim fills out the rest of the Snapshot with widgets displaying important financial information such as their net worth, probability of success, savings rate, effective federal tax rate, and liquidity analysis. Also listed are the upcoming tasks, direct from RightFlows.

Jim determines if additional modules should be reviewed by referring back to the questionnaires within the onboarding process. For example, “If they click yes on high-interest debt, we know we can go over to RightCapital, pull out the debt module, and integrate that into our conversation and our planning goals.”

Sharing your value as an advisor

Jim explains how RightFlows is valuable later on in the financial process when you and the client can look back and see how far you’ve come together. “Keeping those things client facing can be helpful when a client sees the stock market went down that day and says, ‘Does Jim have my back? What's been going on?’” You can say, ‘Here's the ledger of everything we've done to validate the planning fee over the last year.’ That's huge.”

RightFlows is available within the Platinum subscription. To upgrade your subscription, contact our sales team at sales@rightcapital.com or (888) 982-9596; Option: 1. To schedule a demo of the full RightCapital platform for anyone new here, click the link below: