For some clients, the amount of debt carried is even scarier than the most recent season of Stranger Things. In 2019, more than 45% of US families were plagued with credit card debt. Trillions of dollars are associated with mortgages, car loans, personal loans, and student loans. Some might assume that debt is more problematic for younger generations, but total average debt per person is actually highest for Gen X (typically considered as those born between 1965 and 1980), at $146,164. Millennials and Baby Boomers are up next, with around $100,000 each. If your financial planning software doesn’t have a good way to account for this burden and to determine payment solutions for your clients, you may want to look around and find a software that allows you to do the following:

View a client’s entire financial picture

With RightCapital’s six-step client profile section, easily enter balances and payment information about all client financial accounts. If your advisor subscription includes account aggregation, this process becomes even easier as clients can link their accounts while using the client portal which allows balances to automatically update overnight. With clients’ full financial pictures in one place, clearly view assets and liabilities on the balance sheet and identify any debt problem areas. See upcoming debt payments and breakdowns of beginning balances, interest rates, total payments, and ending balances.

Analyze excess cash flow

Within RightCapital’s Retirement > Cash Flows section, identify excess cash flows at the end of each year that could potentially be applied to additional debt payments to pay balances off sooner. You will also be able to analyze how available lines of credit could be for clients moving forward, determine their abilities to pay back loans, and what interest rates they might expect.

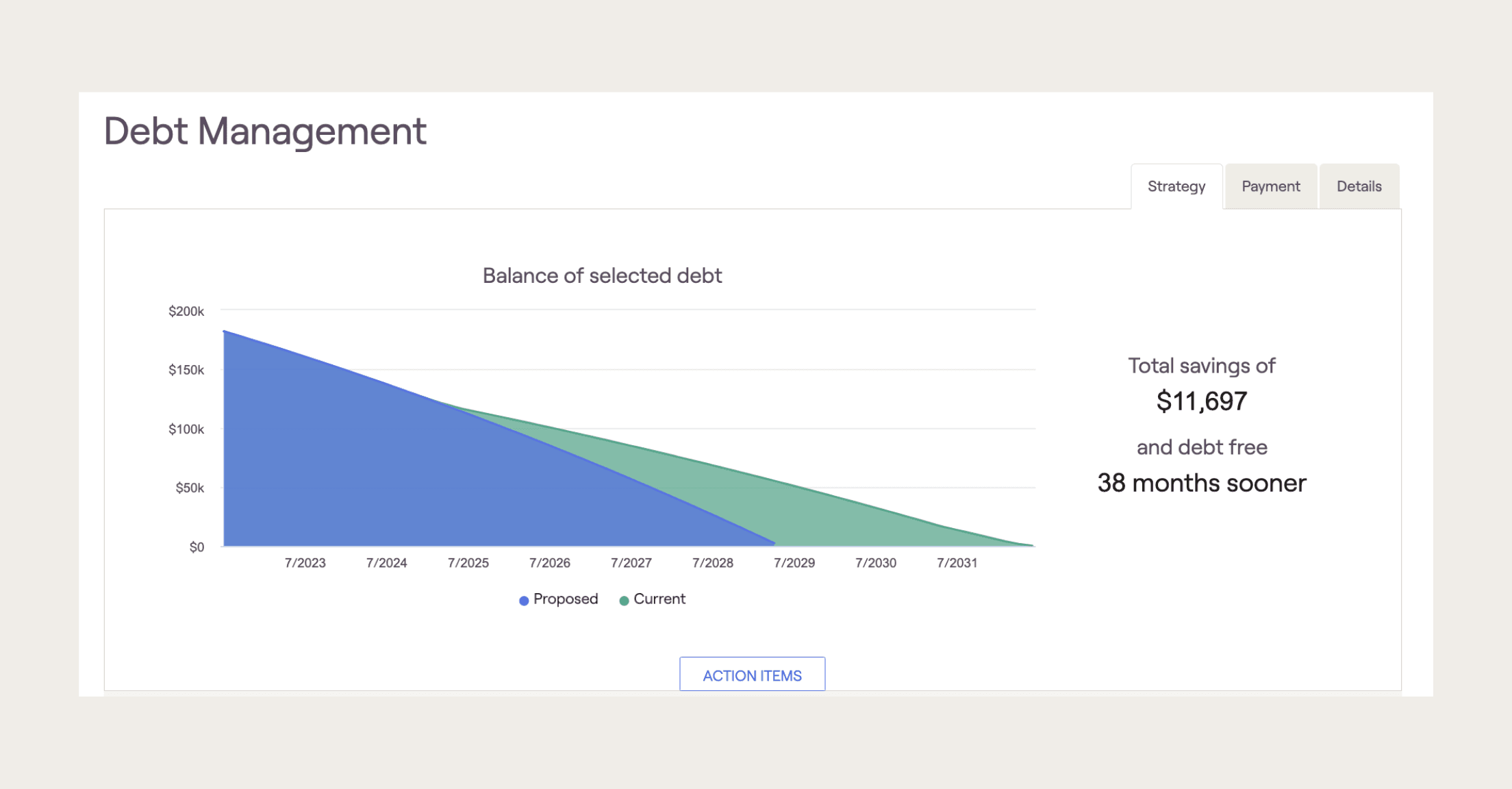

Demonstrate debt paydown strategies with clear visuals

In order to help your clients figure out the next steps, you’ll want to use software that can tackle different strategies. Within the RightCapital Dashboard > Debt section, you can view amortization schedule visualizations of loans. See how much is being paid over time and play around with action items to determine better payoff strategies. Changes you make will clearly identify how much money your clients will save over time and how many months earlier they can be debt free.

Select different options for clients’ debt such as paying off in the order of highest to lowest interest rate (aka “debt avalanche”), in the order of lowest to highest balance (aka “debt snowball”), or refinance the loan and replace it with new terms, updated payment schedules, interest rates, and monthly payments. If you were able to identify opportunities for extra debt payments within the cash flows section, account for them here. You can also model tapping into existing equity with HELOCs or Reverse Mortgages, for example.

Compare multiple scenarios

After modeling out different payment scenarios, you can clearly compare them in the Retirement > Analysis section where you can show probabilities of success for their current financial situation versus for your proposed debt strategies.

Model student loan debt and solutions specifically

RightCapital is the only major financial planning solution for advisors with a specific student loan debt module that can help identify opportunities to pay off loans faster through private refinances or lower payments and work toward forgiveness, using income-based repayment plans such as pay as you earn (PAYE) or revised pay as you earn repayment plans (REPAYE).

Interested in learning more about how you can help your clients manage debt? Schedule a 1:1 with our team today!