How to Make the Most of Your Free RightCapital Trial

October 30, 2025

Have you ever borrowed a book from the library only to barely crack the cover by the time it’s due? We wouldn’t want you to feel rushed like this during your 14-day free trial of RightCapital, so we pulled together a quick guide of how to get to know our financial planning software. Every user is different, so consider this inspiration for your own journey.

Explore your new tool

Log into RightCapital and click “Open Client” on one of the pre-loaded client samples on the left-hand side of your Advisor Portal. You’ll see “Millennial Sample,” “Pre-Retiree Sample,” and “Retiree Sample,” each with different focuses to demonstrate the flexibility of the platform to adapt to your clients’ needs.

You’ll find tabs at the top showing RightCapital’s various modules and features within those modules. Click through sections relevant to your practice and experience the visualizations your clients will love. Don’t miss the following capabilities:

Modern financial planning tools, including:

Social Security optimization

Business planning

One-click Tax Strategies

Stress test

Estate planning

Unique, easy-to-understand visualizations such as:

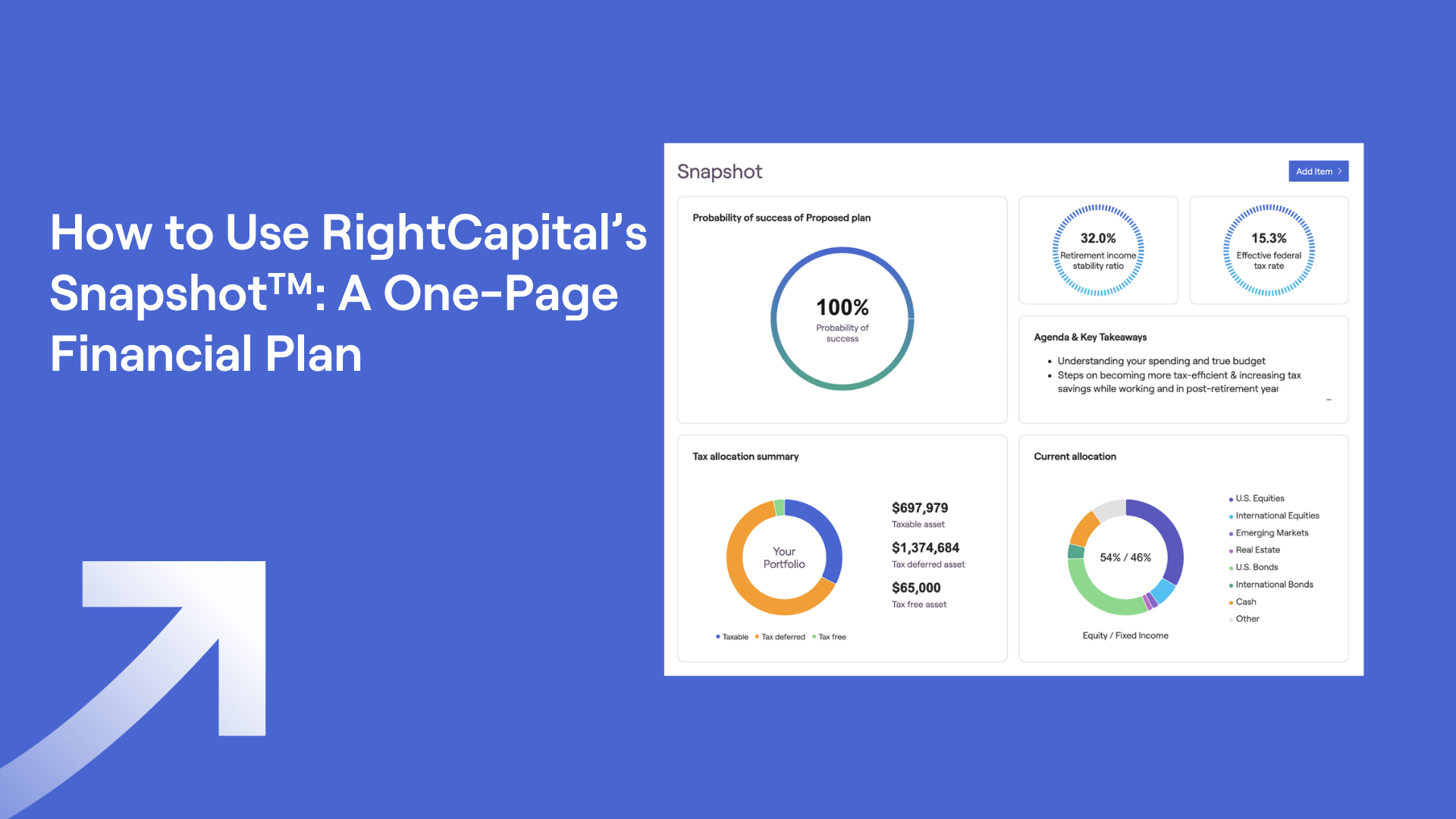

Snapshot, a personalized plan summary

Blueprint, a graphical layout of clients’ net worth, goals, income, savings, and expenses

Cash Flow Maps, a visual of a specific year of a client’s cash inflows and outflows

Time-savings tools, such as:

RightFlows workflow management tool (an optional add-on)

RightIntel business intelligence dashboard

Templates to ensure easy access to your most common customizations in the platform

Create your own plan

Enter your own data

The best way to learn the software is to start with a plan you’re familiar with, so create a plan with your own financial information, or that of a close friend. Choose a traditional step-by-step approach or the visual Blueprint approach. You can decide to include the in-platform Risk module and/or uploads of client documents into the secure Vault as part of the onboarding process.

If you feel as if you need extra assistance with this part, watch the “Creating Your First Plan” webinar, presented weekly on Tuesdays. One advisor stated that he learned about 95% of the information he needed from “Creating Your First Plan.” You’ll learn more about RightCapital’s webinars later on.

Set up your integrations

To reduce data entry time, set up your integrations. According to the most recent Ezra Group WealthTech Integration Score, RightCapital holds the highest score across financial planning software. With more than 40 integrations available, you can connect directly to CRMs, analytics platforms, custodians, clearing firms, and more. It was with the Schwab integration, for example, that Alchemi Wealth was able to successfully migrate 900 clients.

Personalize your platform

If there are certain modules you would like to exclude or bring to the forefront for a certain client, personalize the view for each client or client group. Clients’ planning access can be adjusted further down the line if you’d like to include additional modules as your relationship with the client grows.

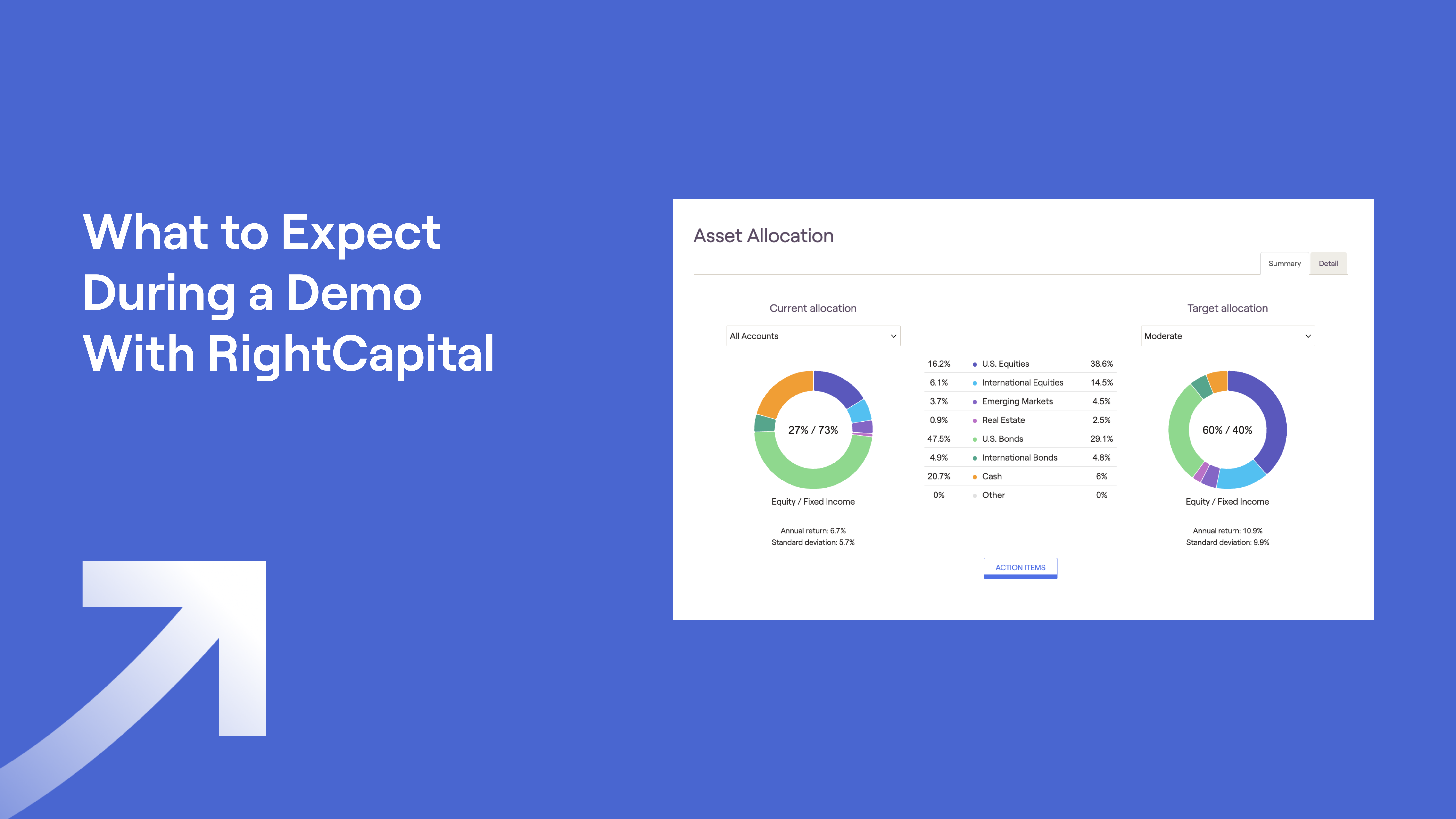

Play around with settings and assumptions. Ensure that the platform is flexible enough to handle variability in factors like asset returns, inflation rates, and other client-specific dimensions. This testing will ensure compatibility with the unique needs of your clients.

Take advantage of our resources

Watch a webinar or two

In addition to every Tuesday’s “Creating Your First Plan,” the RightCapital team also alternates between two sessions of “Overview of the Planning Modules" on Wednesdays (Parts 1 and 2) and between four “Presenting a Plan” sessions on Thursdays (with focuses on presenting to Pre-Retirees, Retirees, High-Net-Worth Clients, and Millennials). These webinars feature detailed overviews, tips and tricks, and interactive Q&As.

If you have more time to dedicate, you’ll find helpful RightCapital specific training webinars each Friday which dive into different planning topics. Previous webinars have included “Implementing Retirement Spending Strategies,” “A Guide to Modeling Properties,” and “Uncover Growth Opportunities Using RightIntel™.” Recordings will be sent after the webinars for further review at your own convenience, or if you are unable to attend live.

CFP® CE webinars are also held monthly. Past topics have included “Implementing Effective Debt Reduction Strategies,” “Maximizing Retirement Savings with Dynamic Spending Strategies,” and “The Role of Behavioral Finance in Financial Planning.”

Click around the Help Center

Each module and topic has a corresponding page within the Help Center, complete with instructions and screenshots. Here’s the article on creating multiple proposed plans, for example. If you are a visual learner, there are a plethora of general training videos or more specific how-to videos available.

Get to know your support team

From day one of your trial, you have full access to the RightCapital’s support team, rated #1 in the industry for financial planning software in multiple Kitces’ studies. Learn why they're ranked so high by using them as additional resources along your trial journey and see how fast they answer your questions.

Some advisors lean on the in-platform chat (answered by real-life humans, by the way), saying, “They’ve been so good at that function that we’ve actually never had to call the customer service line, saving everybody time.” Other users enjoy calling into the support phone line and feel as if they gain “expert-level understanding of the software.” If you’d like to work side-by-side with a trained consultant on a case study, RightCapital offers scheduled calls that fit into your calendar. You can also email support@rightcapital.com with comments or questions.

Ready to gain access to your free RightCapital trial? Schedule a demo today.