Medicare typically covers around half of retirees' healthcare expenses, yet medical costs remain the second-largest expense in retirement, just behind housing. A 2024 study by Fidelity Investments estimates that a healthy 65-year-old couple will need approximately $330,000 to manage healthcare costs throughout their retirement—excluding any long-term care needs.

Clients may seek your guidance during the Medicare enrollment process, as there are many factors to consider when making their election choices. To avoid lifelong financial penalties, it’s important that individuals enroll within the proper timeframes, which depend on age, Social Security status, and existing coverage.

If any of your clients are looking to adjust their Medicare selections, now is the perfect time. Medicare open enrollment takes place from October 15 to December 7, 2024. This is an opportunity for individuals to switch to Original Medicare (Parts A, B, and D) if they are currently enrolled in a different Medicare plan, such as Medicare Advantage (Part C), for the next calendar year.

Let’s walk through the fundamentals of Medicare, as discussed in a recent webinar led by our Customer Relationship Lead, Alexus:

Which expenses does Medicare cover?

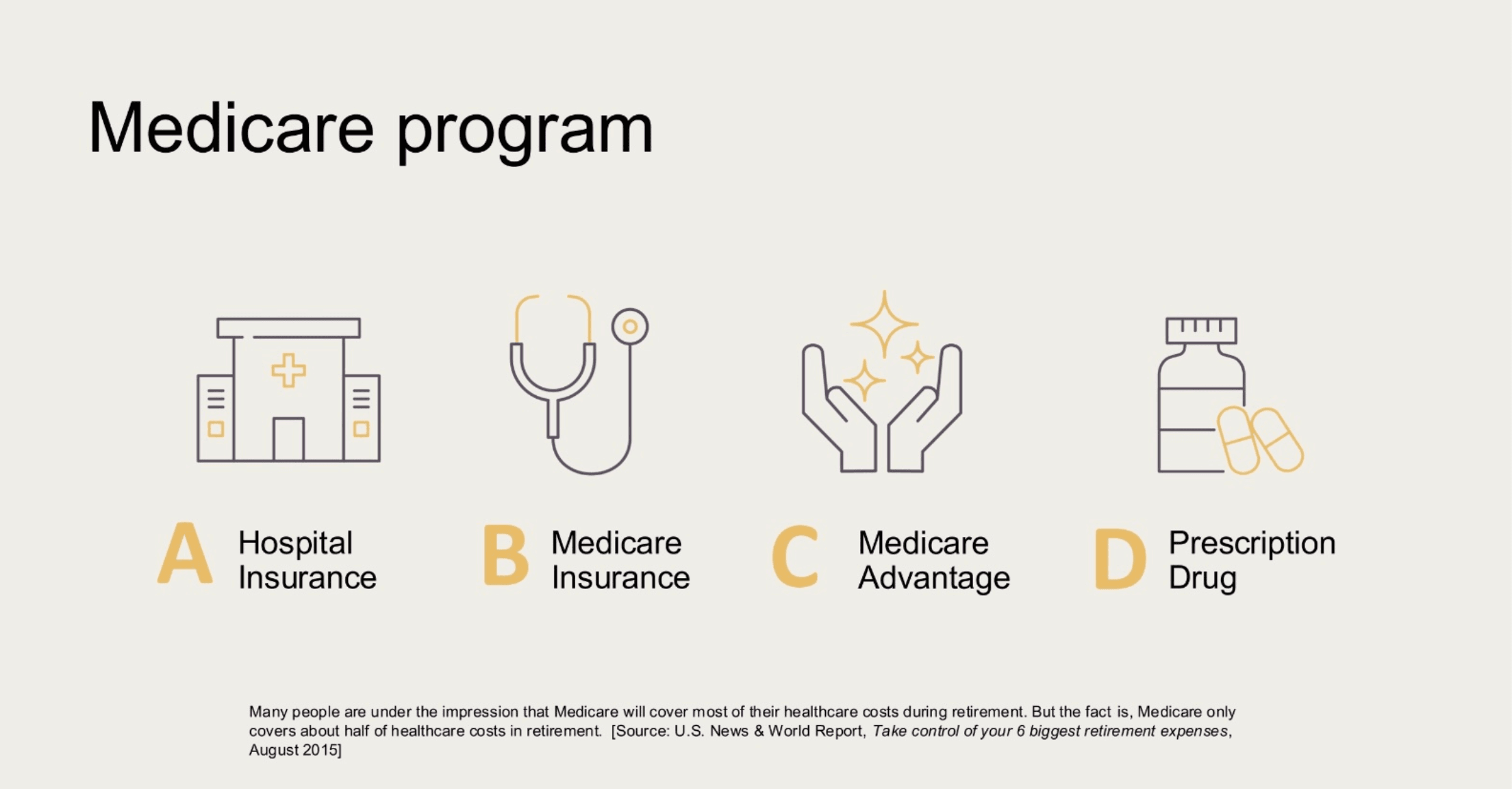

Medicare is divided into four distinct "parts,” which we review below. For more in-depth information, check out the videos after each section where Alexus explains everything in detail:

Medicare Part A - Hospital Insurance

Medicare Part A generally comes with no out-of-pocket premium, but it does require both a deductible and coinsurance. It covers hospital care, provided the patient is admitted under a doctor’s official order. A stay of 1-60 days must meet the $1,632 deductible. Days 61 to 90 have no additional deductible, but there’s a $408 per day coinsurance. Days 90+ come with an $816 per day coinsurance. All this means a 90-day stay could cost your client $13,872.

Medicare Part B - Medicare Insurance

Medicare Part B provides coverage for non-hospital medical services, excluding vision and dental unless the beneficiary has opted in. This includes expenses related to things such as ambulance services, durable medical equipment (DME), and oxygen equipment. Beneficiaries face an annual deductible of $240 and a 20% coinsurance on doctor’s visits and outpatient care. Premiums range from $174.70 to $594, depending on income.

Medicare Part C - Medicare Advantage

Medicare Advantage includes all the benefits of Part A and Part B but is administered by private companies that contract with Medicare. Optional add-ons such as vision, dental, and hearing coverage are available, making Medicare Advantage an all-in-one solution for some clients. Premiums vary by plan and are typically higher than those for Part B.

Medicare Part D - Prescription Drug Coverage

Medicare Part D covers prescription drug costs up to $5,030, with a maximum deductible of $545. After reaching this threshold, beneficiaries are responsible for 100% of costs, though discounts may apply. Monthly premiums range from $12.90 to $81. Once out-of-pocket expenses hit $8,000, catastrophic coverage kicks in, limiting beneficiaries’ payments to no more than 5% of the remaining costs.

Medicare and Inflation Reduction Act of 2022 Changes

The Inflation Reduction Act of 2022 has significantly shaped the landscape of healthcare planning. One key benefit is the $35 monthly cap on insulin, which helps limit price surges for this vital medication. Additionally, starting in 2025, drugmakers will be required to provide rebates if there are sudden spikes in drug prices, helping retirees manage medical expenses more predictably. Future changes include capping out-of-pocket expenses for beneficiaries (effective 2025), and allowing the government to negotiate prescription drug prices, further controlling costs (coming in 2026).

Medigap supplemental plans

Beneficiaries of Original Medicare have the option to sign up for Medigap, a supplemental insurance provided by private companies. Medigap can be combined with Parts A, B, and D to fill gaps in Medicare coverage. However, it cannot be used alongside Medicare Part C (Medicare Advantage), as both are private insurance plans, and their coverage would overlap.

What influences Medicare decisions?

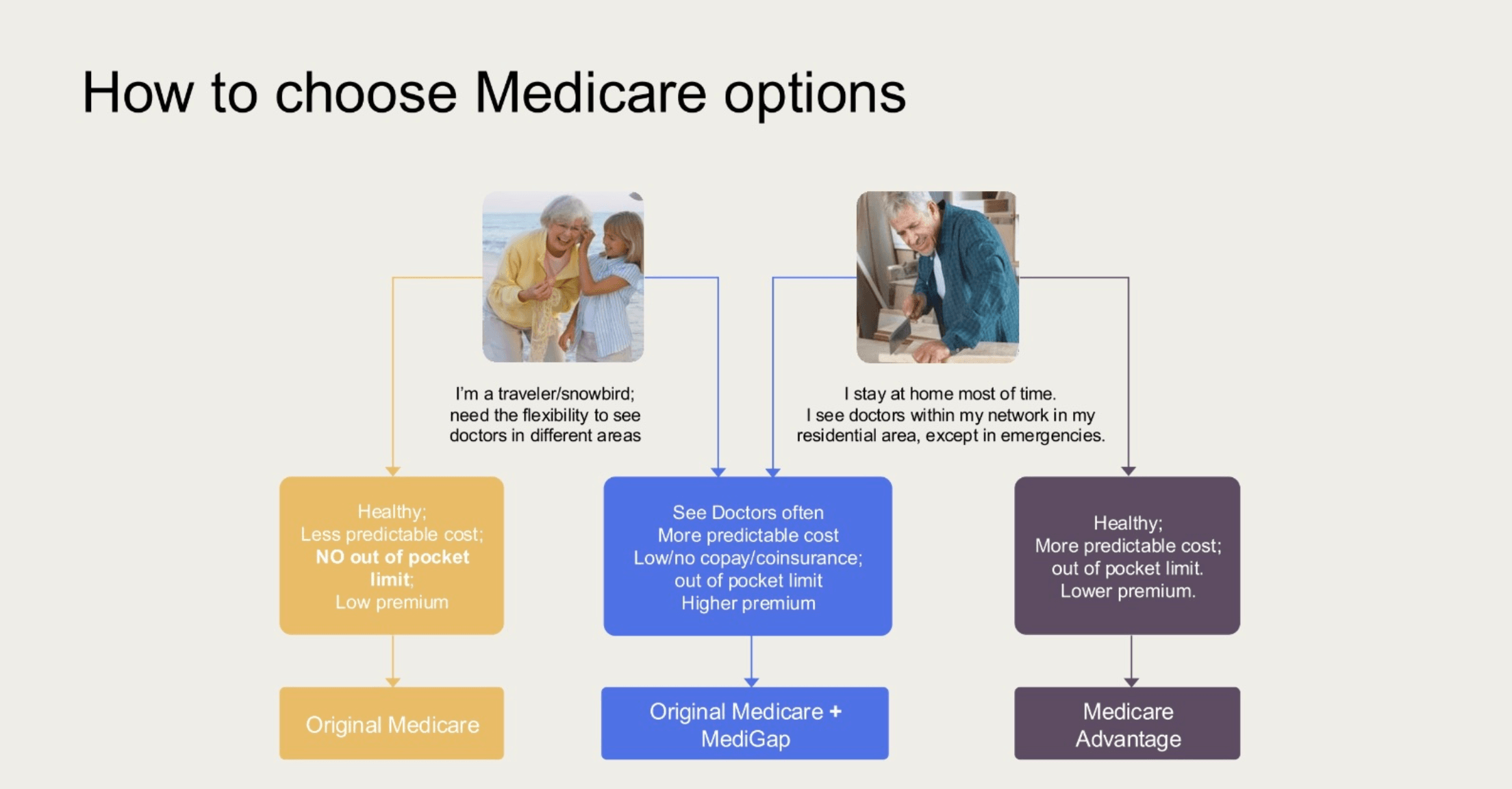

Health and lifestyle

The chart above highlights health and lifestyle scenarios that may apply to your clients. For instance, retirees who travel frequently might prefer Original Medicare, as it provides flexibility to visit doctors wherever they are, without being restricted to a specific network, unlike Medicare Advantage. This may be less of a concern for those planning to stay local.

Clients who require more frequent doctor visits or have more complex health needs might consider adding Medigap to their Original Medicare coverage. While it comes with higher premiums, it provides more predictable out-of-pocket costs, helping to manage ongoing medical expenses.

Retirement income

Medicare Part B and D premiums are determined by your retirement income. With RightCapital, you can develop a retirement drawdown strategy that provides your clients with more tax-efficient distributions. Our platform helps assess the impact of these tax-smart strategies on Medicare Part B and D premiums, particularly when aiming to avoid Income-Related Monthly Adjustment Amounts (IRMAA), which can be triggered by actions such as Roth Conversions.

When should clients enroll in Medicare?

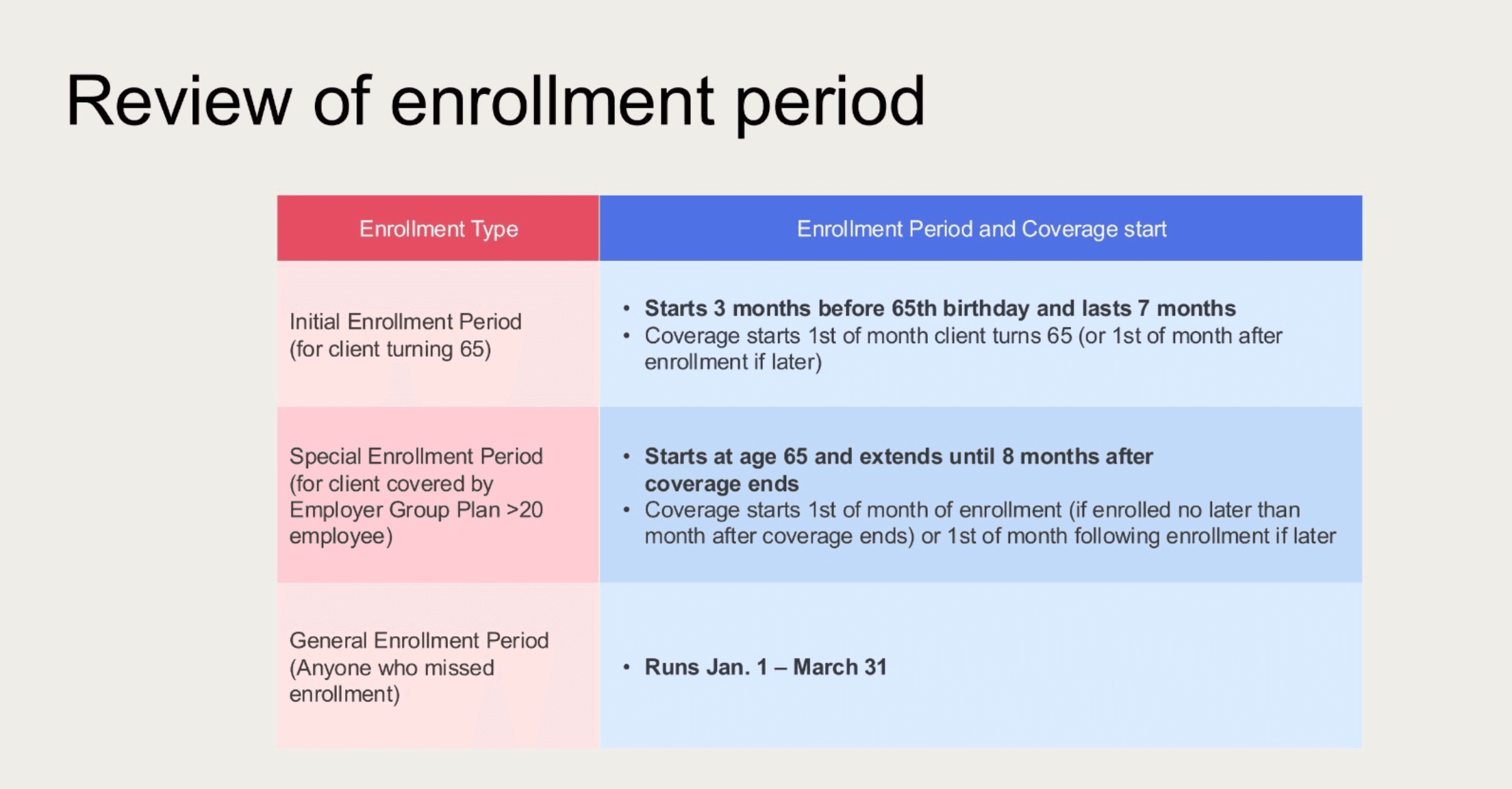

Enrolling at the wrong time can lead to higher premiums. The initial enrollment period begins three months before a client turns 65 and lasts a total of seven months. If your client is already collecting Social Security by their 65th birthday, they'll automatically be enrolled in Medicare Parts A & B. With the RightIntel business intelligence dashboard (included in Premium and Platinum subscriptions), you can choose to receive notifications when clients are approaching 65, enabling you to proactively assist them with Medicare enrollment.

If the client or their spouse is still working at age 65 and covered by a comprehensive employer-sponsored health plan, they may be able to delay enrollment in Part B and Part D. The special enrollment period to re-enroll in Part B extends for eight months after the employer policy ends, while the special enrollment window for Part D (with creditable coverage) is 63 days after the end of the policy.

How can RightCapital help with Medicare decisions?

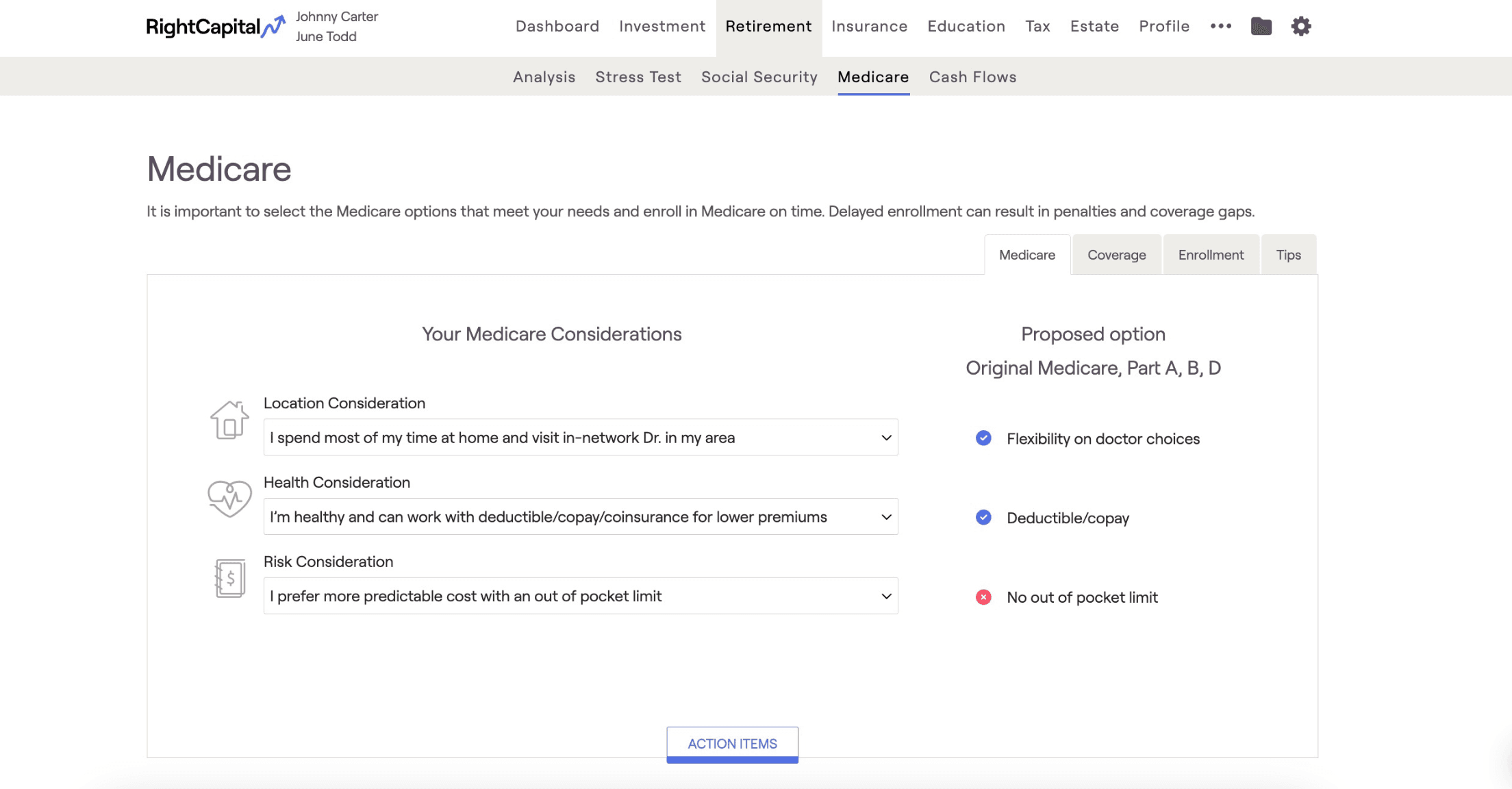

RightCapital streamlines the Medicare planning process for both advisors and their clients through a dedicated Medicare module. This space allows you to easily review key factors such as a client's traveling habits, health status, and premium risk tolerance, ensuring that Medicare filing decisions align with their unique needs.

In addition to assessing these important considerations, the module guides you through any factors that might lead to a non-standard enrollment period, with a helpful breakdown of the client's specific timeline. To further simplify the Medicare filing process, we've included a Tips tab that highlights important points to watch out for, along with direct links to the Social Security Administration and Medicare websites for easy access to additional information.

Our goal is to make Medicare decisions easier and more manageable for your clients, demystifying what can often seem like a complex process.

RightCapital offers additional features to account for Medicare planning. Here's Alexus once again, explaining how you can navigate and address the specific nuances that may arise in various client scenarios:

Navigating Medicare decisions can be challenging and overwhelming, especially as clients face significant life transitions like moving from the workforce into retirement. At this stage, securing the right healthcare coverage becomes a top priority.

RightCapital simplifies this process by helping advisors address questions about Medicare plans, guiding clients through their enrollment periods, and offering peace of mind when they need it most.