Looking for the most recent updates?

Can you believe we are halfway through the year already? Time has been flying and so have the updates from RightCapital. Here are our biggest enhancements over the last three months, including the introduction of RightRisk, an innovative risk assessment module with customizable questionnaires, built right into our financial planning software:

RightRisk™, a fully integrated risk assessment module

RightRisk is a new module that simplifies how you incorporate risk assessments into your financial plans. RightRisk allows you and your clients to view, compare, and analyze risk tolerance scores, all within RightCapital. Key highlights include:

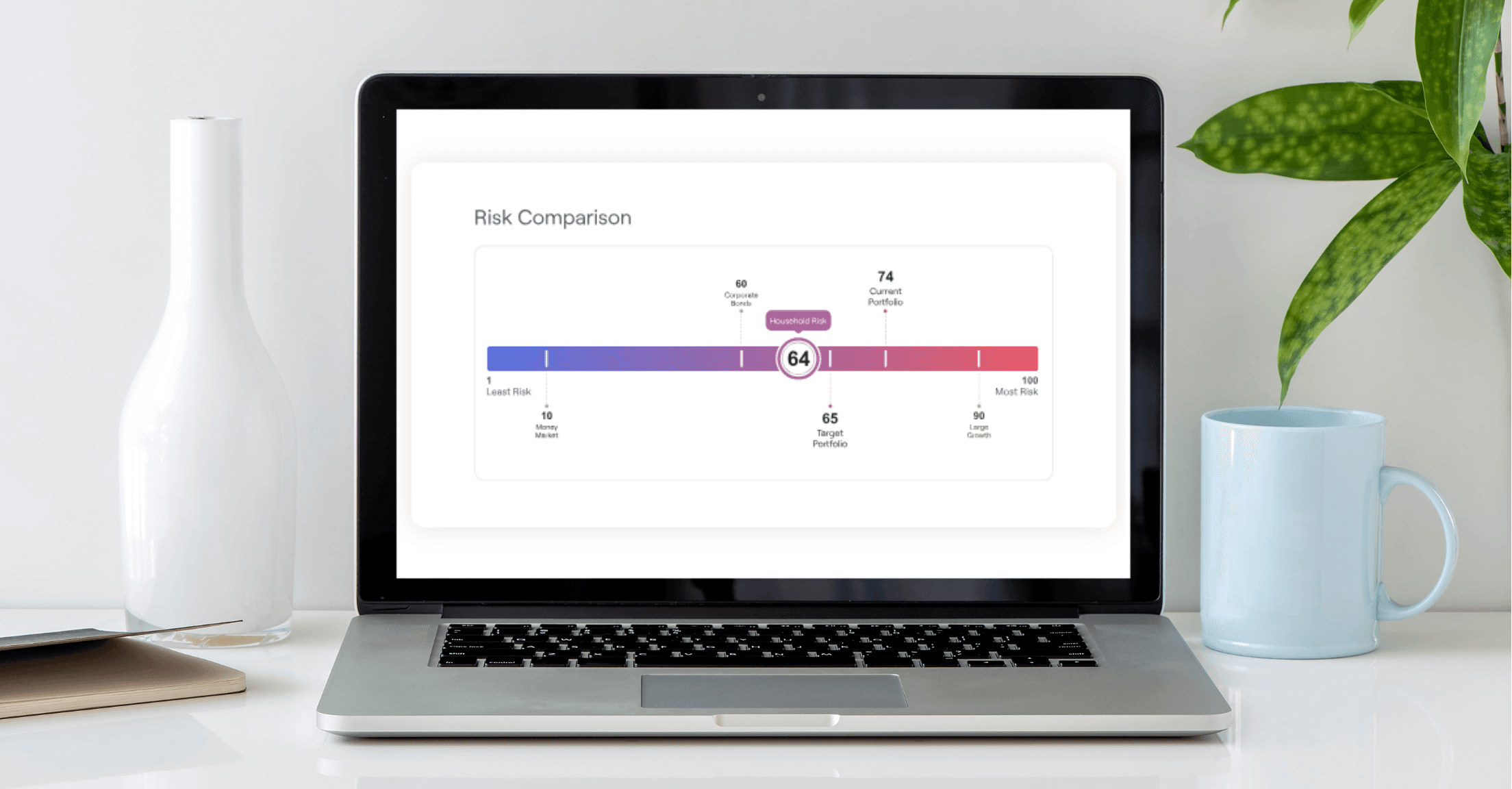

Household risk summary: See how a household risk score compares to its current portfolio, target portfolio, and major asset classes. You can also create custom risk categories to enhance this visual comparison.

Visual risk-return analysis: Help clients easily understand the potential upside and downside returns for their investment portfolios and major asset classes.

Customizable questionnaires: Use our default 13-item questionnaire based on the Grable and Lytton scale or create your own version. Copy existing questionnaires to create new ones.

Flexible ways to engage with clients: Launch the questionnaire immediately during a live client meeting or save it for the client to take later. You can also include the risk score and summary as part of the client’s Snapshot Dashboard or PDF report.

RightRisk is included with RightCapital’s Premium subscription level or higher.

Additional product updates from Q2

RightRisk was definitely our most transformative addition this quarter, but that's not all. Here are a few smaller but impactful updates to help make your financial planning processes easier:

More flexibility with vesting schedules: Advisors can more accurately portray client's vesting schedules by creating custom vesting schedules on an annual, semi-annual, quarterly, and monthly basis.

New gain/loss column for investment holdings: There is a new column in the Investment > Holdings table to easily view any gains or losses for respective accounts. You can sort the Holdings table by the new column and export the data as part of the CSV download.

Redesign of Net Worth: The Net Worth tab has been refreshed for a more modern look and to make it easier to organize the client data. Advisors with account aggregation will also see a Connections panel in the client’s Net Worth tab that displays all connections, the status of each connection, and the number of linked accounts.

Integration with Flourish: We were thrilled to add Flourish to our roster of integration partners. Bring in cash account balances and annuity contract data directly from Flourish into RightCapital's Net Worth tab with just a few clicks. The positions and values will be updated Tuesday through Saturday morning with the previous day’s closing value.

Increase in number of assets and liabilities: To accommodate clients with a significant number of properties, loans, businesses, or other assets, we have expanded the maximum number of each to 100.

Default visibility for tasks and notes: Advisors can specify if newly created tasks and notes will default to "not visible" to the client or "not shared" with the client within Advisor Portal > Preferences. If your firm has RightFlows enabled, super admins can update the preference for new RightFlows tasks in RightFlows > Settings > Preferences.

Extended timeframe for budget expenses: The budget expenses chart in Snapshot and the mobile app now reflects the selected timeframe from the Budget module.

Emojis in the PDF reports: If you love emojis as much as we do, you're in luck. Our PDF reports will now include emojis you've added throughout the plan.

Annual college cost update: The national averages as well as specific college costs have been updated with the latest 2023 data, which will be reflected in your existing financial plans that contain college goals.

Firm-level inflation and miscellaneous assumption controls: The super admin of an org can now enable firm-level inflation and miscellaneous assumptions. When enabled, they can also elect if firm members can use their own assumptions or if they need to use the firm's assumptions.

Do you wish your financial planning software solution provided updates and enhancements on a more frequent basis? Schedule a demo with RightCapital today.