Finding the right financial planning software for your RIA firm can feel overwhelming. With numerous options available, how do you determine which solution will truly elevate your practice and serve your clients effectively?

As an advisor, you need software that balances comprehensive planning capabilities with ease of use, integrates with your existing tech stack, and provides an engaging client experience—all at a price point that makes sense. The challenge: what works perfectly for one advisory firm might not be the right solution for your own.

This guide cuts through the noise to compare the top financial planning software options on the market, helping you identify which solution aligns with your firm's unique needs. It references industry reports such as the Kitces Report, “How Financial Planners Actually Do Financial Planning” and the T3/Inside Information Software Survey, both released in March 2025, so you can learn how other advisors feel about their experiences, not just what each software company says about themselves. This guide will also explore the broader tech stack that advisors need and key features to look for in financial planning software.

7 key features to look for when choosing financial planning software

When evaluating financial planning software options, consider these essential features and attributes:

1. Intuitive user experience

Look for software with intuitive navigation and clear workflows that minimize training time and maximize productivity. The best platforms balance sophisticated capabilities with ease of use for both advisors and clients.

2. Comprehensive planning capabilities

Ensure the software supports the full range of planning needs for your client base, including retirement planning, tax planning, Social Security optimization, estate planning, education funding, and insurance analysis.

3. Strong integration ecosystem

Select a platform that integrates seamlessly with your existing tech stack, including your CRM, custodian, and performance reporting platform, to create an efficient workflow.

4. Engaging client experience

Prioritize software with an interactive client portal that provides a clear financial dashboard, document sharing capabilities, and collaborative planning tools to enhance client engagement.

5. Scenario modeling flexibility

Choose software that allows you to easily create and compare multiple planning scenarios to help clients understand trade-offs and make informed decisions.

6. Ongoing innovation

Select a provider with a track record of regular updates that can address ever-changing regulations and a commitment to incorporating advisor feedback into product development.

7. Solid customer support

Make sure you will get the responsive customer support that you need to learn the system and to troubleshoot any issue you may be having via chat, email, and phone. Bonus if you can schedule time in advance of a client meeting to do a plan review.

Comparison of financial planning software for advisors

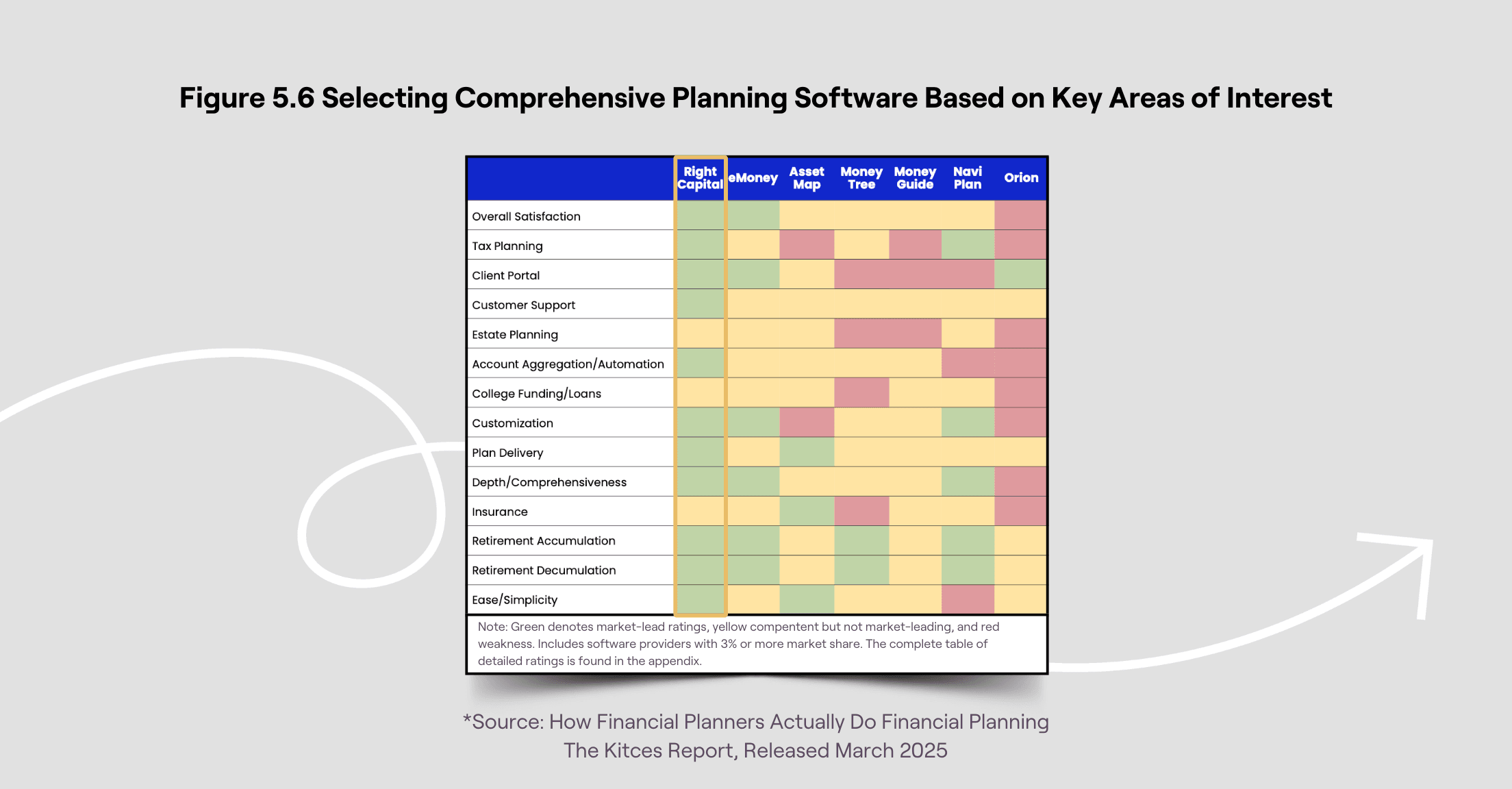

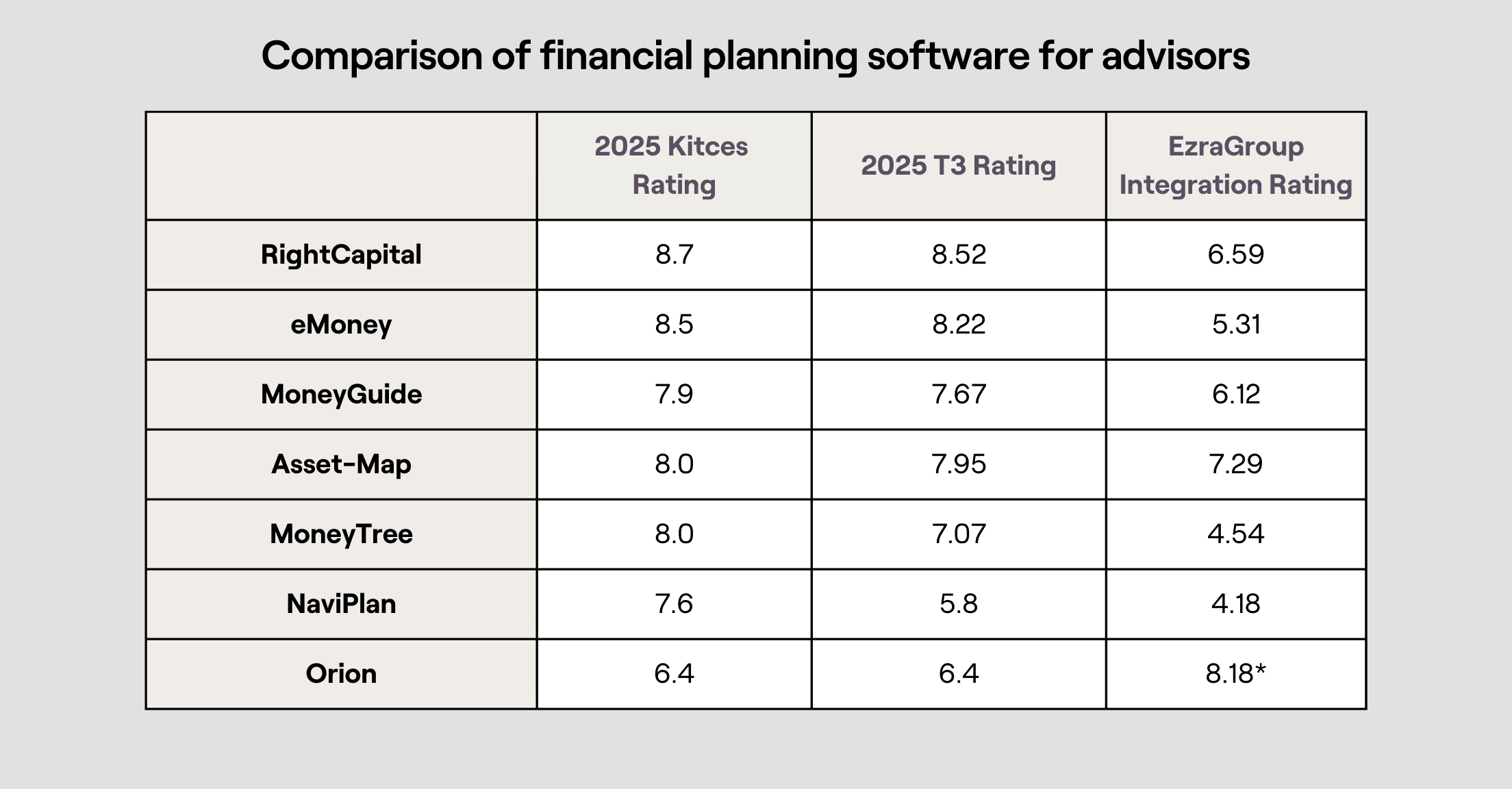

To help you make an informed decision, we've compared the top financial planning software options, highlighting their key features and industry ratings.

RightCapital vs. eMoney vs. MoneyGuide - the "Big Three"

RightCapital

RightCapital has rapidly gained market share by striking an ideal balance between comprehensive planning capabilities and an intuitive user experience. The platform was built from the ground up with modern technology, allowing for faster updates and a more responsive interface than many legacy systems.

Industry report ratings:

Kitces Rating: 8.7/10

T3 Rating: 8.52/10

Ezra Group Integration Rating: 6.59/10

Market-leading ratings for (according to the Kitces Report):

Overall Satisfaction

Tax Planning

Client Portal

Customer Support

Account Aggregation/Automation

Customization

Plan Delivery

Depth/Comprehensiveness

Retirement Accumulation

Retirement Decumulation

Ease/Simplicity

Planning method:

Cash-Flow Planning

Goals-Based Planning

Modified Cash-Flow Planning

Key features:

Investment planning

Retirement planning

College planning

Tax planning

Estate planning

Secure document vault

Lead generation

Custom branding

Account aggregation

Budgeting tools

Smart transaction categorization

eMoney

eMoney has established itself as a comprehensive financial planning solution with a focus on detailed cash flow planning and client portal functionality. The platform offers capabilities for advisors serving high-net-worth clients with complex planning needs.

Industry report ratings:

Kitces Rating: 8.5/10

T3 Rating: 8.22/10

Ezra Group Integration Rating: 5.31/10

Market-leading ratings for (according to the Kitces Report):

Overall Satisfaction

Client Portal

Customization

Depth/Comprehensiveness

Retirement Accumulation

Retirement Decumulation

Planning method:

Cash-Flow Planning

Goals-Based Planning (with additional fee)

Key features:

Client portal

Secure file sharing and storage

Spending and budgeting tools

Business analytics

Insights and data

Account aggregation

Integrations

For a deeper comparison, check out this RightCapital vs. eMoney article.

MoneyGuide

MoneyGuide pioneered goals-based financial planning software and continues to be a popular choice for advisors who prefer this approach over detailed cash flow planning. The platform focuses on helping clients prioritize and fund their most important goals.

Industry report ratings:

Kitces Rating: 7.9/10

T3 Rating: 7.67/10

Ezra Group Integration Rating: 6.12/10

No market-leading ratings (according to the Kitces Report)

Planning method:

Goals-Based Planning

Key features:

Advanced lifetime protection

Allocation comparison

Business & plan analytics

Client planning portal

Custom CMA's

Complimentary assistance licensing

Custom report templates

Holistic stress testing

Online fact finder

Retirement distribution

Risk tolerance

Social Security optimization

Tax planning

Test variables in Play Zone®

For more details, explore this RightCapital vs. MoneyGuide comparison.

Additional financial planning software options

Asset-Map

Asset-Map provides a visual approach to financial planning, allowing advisors to create a comprehensive map of a client's financial situation. This tool helps in identifying gaps and opportunities in a client's financial plan, making it easy to communicate complex financial concepts.

Industry report ratings:

Kitces Rating: 8/10

T3 Rating: 7.95/10

Ezra Group Integration Rating: 7.29/10

Market-leading ratings for (according to the Kitces Report):

Plan Delivery

Insurance

Ease/Simplicity

Planning method:

Visual financial mapping that can enhance both cash flow and goal-based planning

Key features:

Visual financial mapping

Reporting tools

Scenario analysis

Integration capabilities

Collaboration features

Client portal

MoneyTree

MoneyTree provides comprehensive financial planning solutions with a focus on cash flow and retirement planning. It offers detailed projections and analysis.

Industry report ratings:

Kitces Rating: 8/10

T3 Rating: 7.07/10

Ezra Group Integration Rating: 4.54/10

Market-leading ratings for (according to the Kitces Report):

Retirement Accumulation

Retirement Decumulation

Planning method:

Cash-Flow Planning

Goals-Based Planning

Key features:

Audit trail

Fully customizable withdrawal order

Reports

One-page summary

Client portal

Interactive what-if scenario tools

Planning pages

Future changes table

Specialized planning tools such as education planning, estate planning, and life insurance analysis

NaviPlan

NaviPlan offers detailed cash flow and goal-based planning capabilities. It is known for its robust scenario analysis and ability to handle complex financial situations.

Industry report ratings:

Kitces Rating: 7.6/10

T3 Rating: 5.8/10

Ezra Group Integration Rating: 4.18/10

Market-leading ratings for (according to the Kitces Report):

Tax Planning

Customization

Depth/Customization

Retirement Accumulation

Retirement Decumulation

Planning method:

Cash-Flow Planning

Goals-Based Planning

Key features:

Account aggregation

Advanced tax planning

Asset allocation & risk tolerance

Business planning

Client portal

Collaborative financial planning

Compliance workflow

Custom client reports

Equity compensation

Estate planning

Financial fact finder

Guided retirement

Insurance planning

Monte Carlo analysis

Retirement income modeling

Scenario analysis

Orion

Orion is an all-in-one software program that includes financial planning features. It offers basic planning capabilities for advisors looking to combine investment management with financial planning.

Industry report ratings:

Kitces Rating: 6.4/10

T3 Rating: 6.4/10

Ezra Group Integration Rating: 8.18/10 (for full solution)

Market-leading ratings for (according to the Kitces Report):

Client Portal

Planning method:

Cash-Flow Planning

Goals-Based Planning

Key features:

Portfolio accounting

Client portal

Compliance

Financial planning

Trading

Risk intelligence

What types of platforms and apps do financial advisors need?

While financial planning software often forms the core of an advisor's technology stack, a comprehensive tech ecosystem includes several complementary platforms to help advisors deliver exceptional service and maintain efficient operations:

CRM (Customer Relationship Management) systems

How advisors use it: CRM systems serve as the central hub for client data, communication history, and workflow management

Benefits: Streamlines client service, ensures consistent follow-up, facilitates team collaboration, and provides business intelligence for practice management

Popular options: Redtail, Wealthbox, Advyzon, SmartOffice, Salesforce Financial Services Cloud

Document processing systems

How advisors use it: Securely sends and provides a way for clients to sign documents

Benefits: Offers an efficient client experience that can reduce the tasks of printing, scanning, and mailing, or the need to meet in-person

Popular options: Docusign, Adobe Sign, Citrix ShareFile, Dropbox, LaserApp

Document management systems

How advisors use it: Securely stores and organizes client documents, financial statements, and firm resources with appropriate access controls

Benefits: Ensures regulatory compliance, facilitates secure document sharing, and creates a centralized repository for important information

Popular options: Microsoft SharePoint, OneDrive, Citrix Sharefile, Google Drive, Box.com

Cybersecurity

How advisors use it: Ensures that your firm is compliant and secure

Benefits: Tests, assesses, advises, and implements cyber solutions

Popular options: KnowBe4, Smarsh Entreda Unify, Advisor Armor, WebRoot, Visory

Marketing and lead generation tools

How advisors use it: Attracts prospects, nurtures leads, and builds the firm's digital presence through content marketing and social media

Benefits: Supports business growth, establishes thought leadership, and creates a consistent pipeline of qualified prospects

Popular options: FMG Twenty Over Ten/Marketing Pro, Snappy Kraken, Nitrogen, Broadridge AdvisorStream

Conclusion

Selecting the right financial planning software is an important decision that impacts your firm's efficiency, client experience, and ultimately, your business growth. While each platform has its strengths, RightCapital stands out for its optimal balance of comprehensive planning capabilities and intuitive user experience, making it an excellent choice for most advisory firms.

Ultimately, the best software for your firm depends on your specific client base, planning philosophy, and business model. Consider scheduling demos with your top contenders to experience each platform firsthand before making your decision.

Ready to see how RightCapital can transform your planning process and client experience? Book a personalized demo today to explore how our intuitive platform can help you deliver more value to clients while growing your business.

Financial planning software FAQ

What is the best software for financial advisors?

The "best" financial planning software depends on your firm's specific needs, client base, and planning approach. Each solution offers unique features that cater to different planning styles and client needs.

How does financial planning software save time for advisors?

Financial planning software saves advisors time through automation, streamlined workflows, and centralized data management. Modern platforms automate complex calculations, scenario modeling, and report generation that would otherwise require hours of manual work. They eliminate the need for multiple spreadsheets by centralizing client data and planning assumptions in one system. Client portals reduce administrative burden by enabling self-service account aggregation and document sharing. Integration with other advisor tools (such as CRM, custodians, and portfolio management platforms) eliminates duplicate data entry and creates a seamless workflow. Additionally, reusable templates and model plans allow advisors to standardize common planning scenarios, further enhancing efficiency.

How do I choose the right financial planning software for my advisory firm?

To choose the right financial planning software, start by assessing your firm's specific needs, including client demographics, planning complexity, and existing technology. Define your priorities—whether that's comprehensive cash flow modeling, tax planning capabilities, or client engagement tools. Evaluate integration capabilities with your current tech stack, particularly your CRM and portfolio management systems. Consider your team's technical proficiency and the software's learning curve. Review pricing structures to ensure alignment with your business model. Finally, schedule demos with top contenders, request references from current users, and if possible, arrange a trial period to experience the software in your actual workflow before making a decision.

Book a RightCapital demo today and see how our intuitive platform simplifies planning and engages clients.